Housing Prices, Tulip Mania, and Taming the Mortgage Monster

Tuesday, November 9, 2021

Risk Commentary

Housing occupies a unique place on the financial spectrum; on the one hand, it is a massive store of wealth for most families, and on the other hand, it has been at the heart of the two recent major financial crises (i.e., the late 1980s and early 1990s Savings and Loan Crisis and the 2008 Credit Crisis) and a supporting role in most other financial crises. This installment attempts to shed some light on the symptoms for identifying crises hopefully well before most of the market does.

A walk along Memory Lane - the S&Ls

For those who have recently joined the financial community and for those who have intentionally forgotten, the S&L Crisis was caused by financial institutions (primarily S&Ls) borrowing short and lending long. As interest rates rose, the S&Ls were stuck with low-yielding assets as the cost of their liabilities skyrocketed. “Unprecedented!, Outrageous!” screamed the bankers as they tried in vain to adjust to the rapidly rising interest costs (Ten Year Treasuries rose from approximately 8.0% in 1978 to nearly 16% in 1980) reflected in the below graph near 1980:

Figure I: Ten Year Treasury Bond Yields

Source: https://www.macrotrends.net/2016/10-year-treasury-bond-rate-yield-chart

Of course, homeowners benefitted from the low rates as the duration of mortgages gapped out, a reflection of the relative benefit of homeowners with below-market mortgages. Try as they may, the S&Ls could not offset the misery of massive increases in funding costs and mortgages with below market yields, with the upshot being a deluge of insolvent institutions and the federal government being forced to step in via the Resolution Trust Company.

A further walk along Memory Lane - the 2008 Credit Crisis

For those who have recently joined the financial community, the 2008 Credit Crisis is considered by many to be the largest financial event since the Great Depression. The so-called monoline insurance companies (e.g., MBIA and AMBAC) had provided financial guarantees for various structured finance instruments such as Collateralized Debt Offerings (CDO’s) and unfortunately, did not have the financial strength to make good on those guarantees. Like a house of cards, once the monolines incurred difficulty, then the holders and issuers of the structured securities ran into problems, then the investment banks, then the commercial paper issuers, etc. until the Federal government via the FED and Treasury issued approximately 17 programs to stabilize the markets. A royal mess to be sure. Of course, various safeguards were put in place to reduce the probability of a repeat, but perhaps the most powerful force was the 17 programs primarily the FED has to counter future problems. A surprise to many market observers was the short impact of the COVID crisis, probably because of the utilization of the FED’s new-found powers and its massive buying as reflected by the rise in its and other central banks’ balance sheets:

Figure II: Central Bank Assets

Source: http://fingfx.thomsonreuters.com/gfx/rngs/GLOBAL-CENTRALBANKS/010041ZQ4B7/index.html

Tulip Mania

Before turning to current conditions, it is worthwhile to examine the case of one of the largest financial disasters in history and that is the tulip bulb craze. There is no doubt that tulips are a beautiful flower and standing in a bed of them one might easily assume that they reached nirvana. However, the reality is that a tulip is simply a plant with the only real benefit being its blooming beauty. Hence, lending against such an ephemeral quality as beauty, prudence is probably the best protocol. Once prices become unchained to prices for other landscaping materials, there can be little doubt that all will not end well.

Tethering Housing Prices

Like tulip prices, home prices should be tethered to income levels and rental levels since homes serve a basic purpose of providing shelter. Once prices significantly exceed those values, troubles are likely to ensue.

Current Conditions

So where are we? For better or worse, average home prices have risen from $360K to approximately $455K over the past 10 years (see Figure III below) while interest rates are near all-time lows (see Figure I above).

Figure III: Average Sales Prices of Homes Sold in the United States

Source: https://fred.stlouisfed.org/series/ASPUS

The Rub

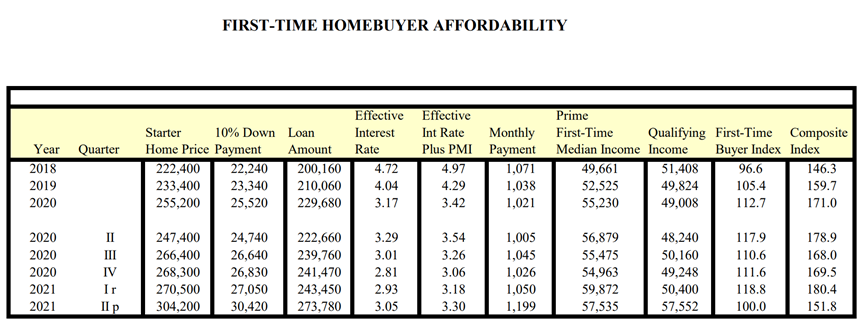

Matching up home prices and affordability, the current trend is not comforting as the Affordability Index for first time buyers has recently deteriorated from 118.8 to 100.0 (see Table I below), meaning that there is no excess income for home purchases. Combine that fact with the likely rise in mortgage rates resulting from increasing inflation, and we have some factors worth monitoring.

Nota bene: The NATIONAL ASSOCIATION OF REALTORS® affordability index measures whether or not a typical family could qualify for a mortgage loan on a typical home. A typical home is defined as the national median-priced, existing single-family home as calculated by NAR. The typical family is defined as one earning the median family income as reported by the U.S. Bureau of the Census. The prevailing mortgage interest rate is the effective rate on loans closed on existing homes from the Federal Housing Finance Board. These components are used to determine if the median income family can qualify for a mortgage on a typical home.

Table I: Affordability Index (less than 100 is problematical)

Prognosis

While the decline in affordability and the rise in interest rates are concerns, assuming the job market does not crash (in fact, it is going the opposite way) and interest rates do not skyrocket (many sovereign nations cannot afford material increases), the current situation should remain manageable.

How we can help

Egan-Jones Ratings Company started providing ratings in 1995 for the purpose of issuing timely, accurate ratings. EJR is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider. EJR is certified by the European Securities and Markets Authority (ESMA) and recognized as market leader in Private Placement ratings. EJR also provides independent credit rating research, Climate Change / ESG scores, and Proxy research and recommendations.

Prospective clients have often asked how we can help them and what areas we consider are particularly

strong. In response, below are the areas worth reviewing:

Private Placement Ratings – assisting investors access private markets via ratings on private placements.

Subscription Ratings – we have had a strong track record in providing early, accurate independent credit

rating research.

Climate Change / ESG Scores – an assessment of entities’ current and prospective scores.

Independent Proxy Research and Recommendation/Voting – assisting fiduciaries in fulfilling their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.