Egan-Jones CLO* Summary Report (April 2024)

Egan-Jones CLO* Summary Report (April 2024)

*Egan-Jones' ratings in this report are not issued under an NRSRO license

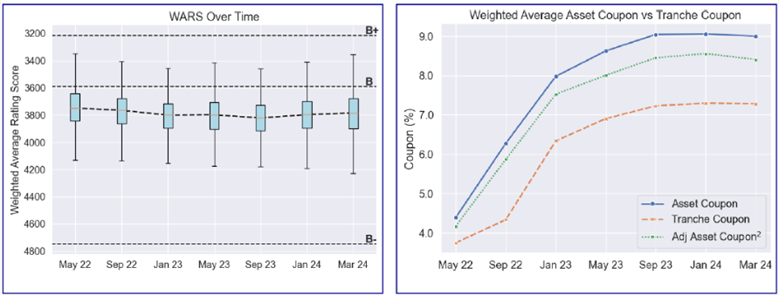

Despite increases in treasury yields since December, CLO issuances reached another max in March (80) since November 2021 (94)¹. Multiple rate cuts are still expected in 2024, however supply chain bottlenecks due to terrorist attacks on shipping in the Straight of Hormuz could have delayed effects on inflation, which might reduce the expected number of rate cuts. As can be seen on the below right chart entitled “Weighted Average Asset Coupon vs. Tranche Coupon”, tranche coupons and asset coupons have remained relatively flat near 7.3% and 9.0% respectively, while adjusted asset coupon (adjusted for estimated losses) has seen modest declines since January. Watch for declines in tranche coupons as the lower base yields work through the market. Interestingly, the range of CLOs’ collateral over deal equity has widened, a trend which has occurred since May 2022 (see Chart I-E). A comforting sign is the continued elevation of senior tranche subordination (Chart I-C) and CCC+ or Lower Rating Percentages have declined below September 2023 levels (Chart I-D).![]()

![]()

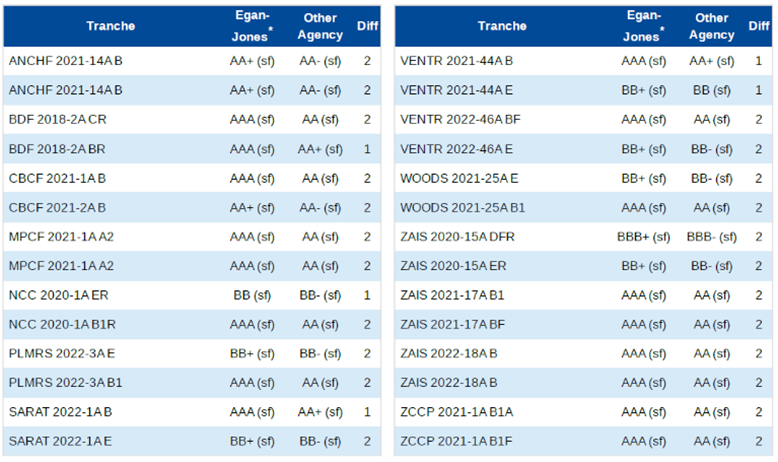

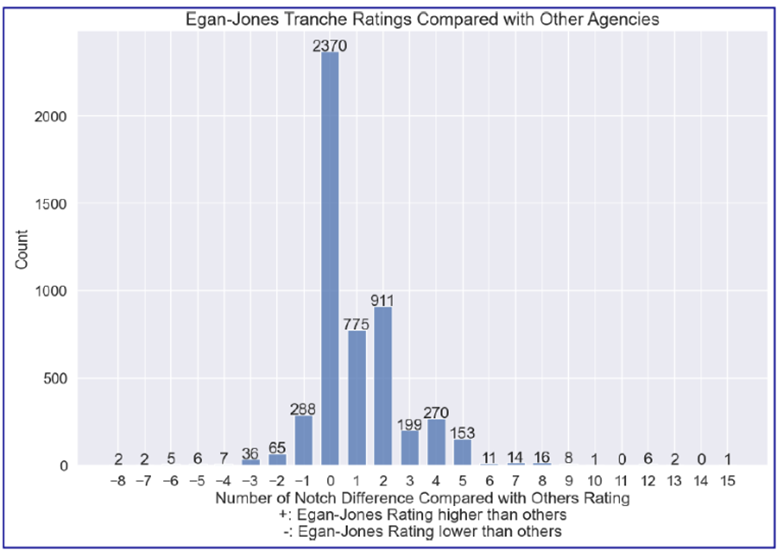

Currently, Egan-Jones tends to have a more positive view of CLO credit quality as compared to other credit rating agencies, as demonstrated in the table below.

I. Deal Key Metrics Summary

As of March 2024, Egan-Jones rated 1529 CLO deals. We collected and calculated available deal level, tranche level and asset level key metrics such as deal weighted average rating factor and tranche subordinations, compared with prior period(s) analysis results and summarized highlights below.

I-A. Weighted Average Rating Score

Egan-Jones collected the weighted average rating score (WARS)³ of covered CLO deals. The 25th, 50th, and 75th percentiles of the WARS value were 3679, 3784, and 3899, respectively.

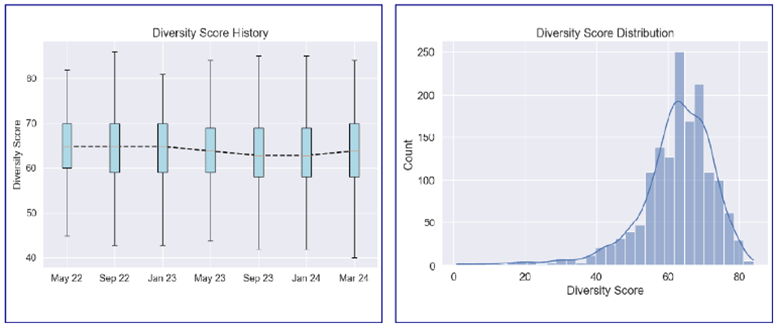

I-B. Diversity Score

![]()

Egan-Jones collected the Diversity Score (DS)⁴ of covered CLO deals. The 25th, 50th, and 75th percentiles of the DS value were 58, 64, and 70, respectively. Egan-Jones calculated and compared the monthly average value of DS data from May 2022 to this month. The mean value of DS has decreased over the observed period, which indicates the diversity level of the portfolios might be decreasing.

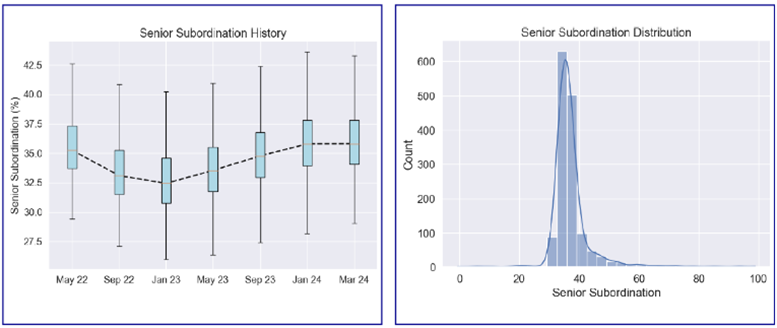

I-C. Super Senior Tranches Subordination

Egan-Jones collected the senior tranches subordination⁵ (%) (STS) of covered CLO deals. The 25th, 50th, and 75th percentiles of the STS value were 34.1, 35.8, and 37.8, respectively.

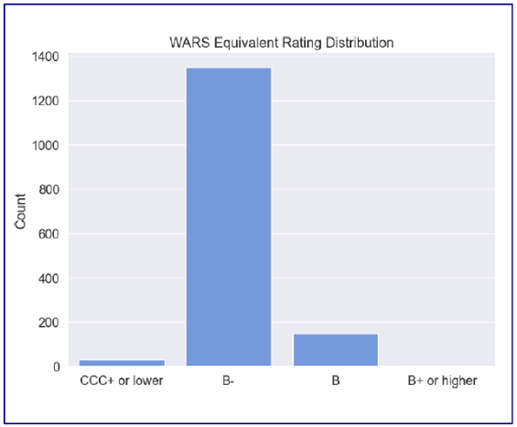

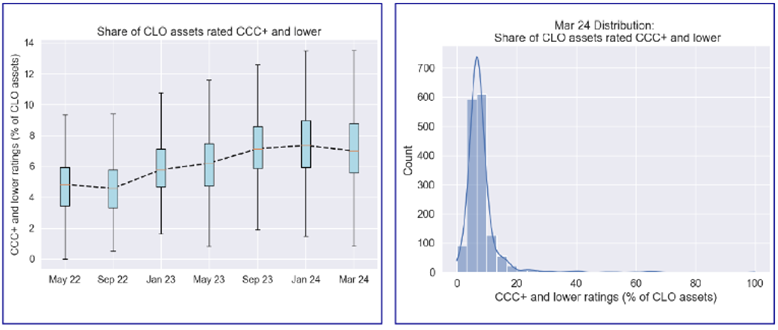

I-D. CCC+ or Lower Rating Percentage

![]()

Egan-Jones collected the CCC+ and Lower Rated Asset Percentage (%) (CLRA) of covered CLO deals. The 25th, 50th, and 75th percentiles of the CLRA value were 5.6, 7.0, and 8.8, respectively. Egan-Jones calculated and compared the monthly average value of CLRA data from May 2022 to this month. The mean value of CLRA has increased over the observed period, which indicates the percentage of lower rated assets might be increasing.

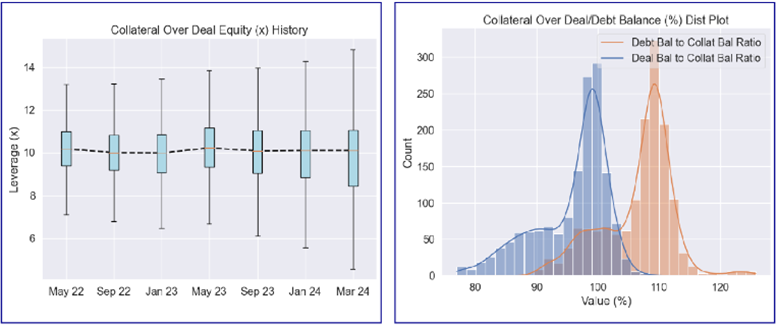

I-E. CLO Leverage Summary

Note: Deal balance is the sum of current balance of all deal tranches; Debt balance is the sum of current balance of all debt tranches.

Egan-Jones reviewed various liability / asset metrics. The 25th, 50th, and 75th percentiles of the total deal balance to collateral balance (total current tranches balance / current collateral balance) were 92.0%, 98.0%, and 100.0%, respectively. The 25th, 50th, and 75th percentiles of the debt balance to collateral balance (current non-equity tranches balance / current collateral balance) were 103.0%, 108.0%, and 110.0%, respectively.

II. Tranche Key Metrics Summary

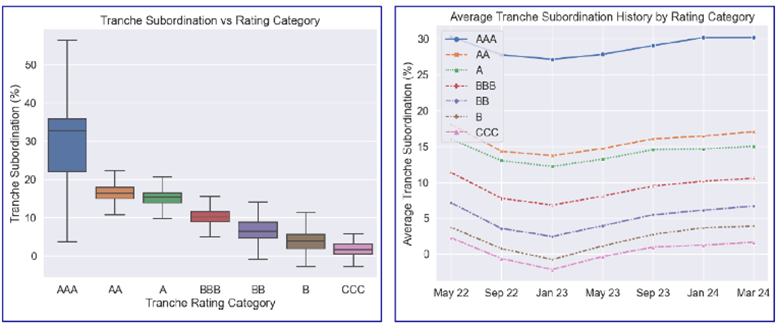

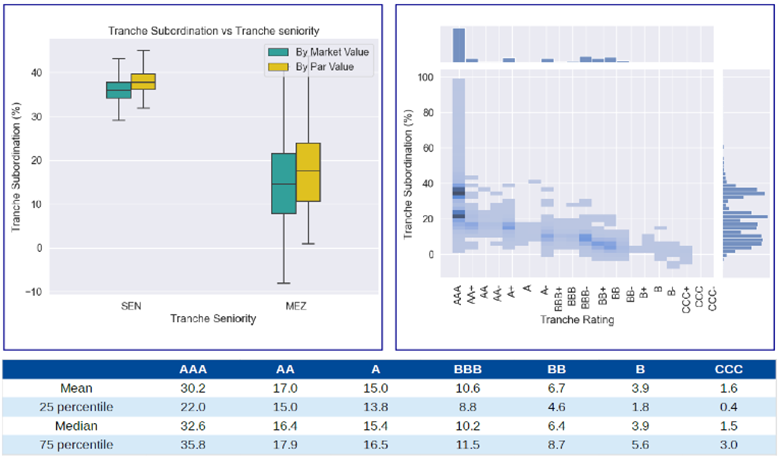

II-A. Tranche Subordination Analysis

The average subordination levels (defaulted assets are valued at market value) of senior tranches and mezzanine tranches tranches were 37.3% and 15.1%, respectively. The 25th, 50th, and 75th percentiles of senior tranche subordination levels (defaulted assets are valued at market value) were 34.1%, 35.9%, and 37.7%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche subordination levels (defaulted assets are valued at market value) were 7.8%, 14.5%, and 21.4%, respectively.

The mean, 25th, 50th, and 75th percentiles of the available subordination of each rating category (includes +/-) can be found in table above.

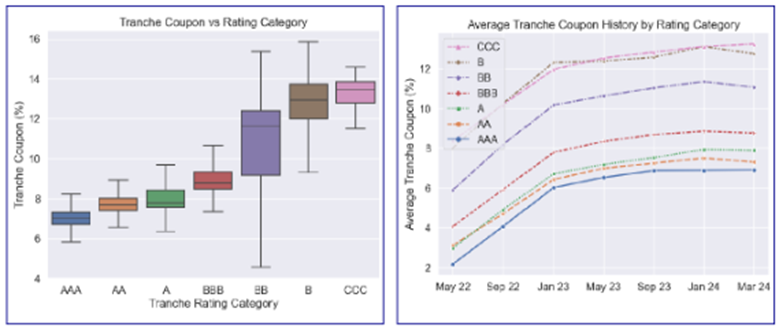

II-B. Tranche Coupon Analysis

The average coupon of senior tranches and mezzanine tranches are 6.5% and 8.8%, respectively. The 25th, 50th, and 75th percentiles of senior tranche coupon are 6.6%, 6.7%, and 6.9%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche coupon are 7.3%, 8.2%, and 10.7%, respectively.

The mean, 25th, 50th, and 75th percentiles of the available coupon of each rating category (includes +/-) can be found in the table above.

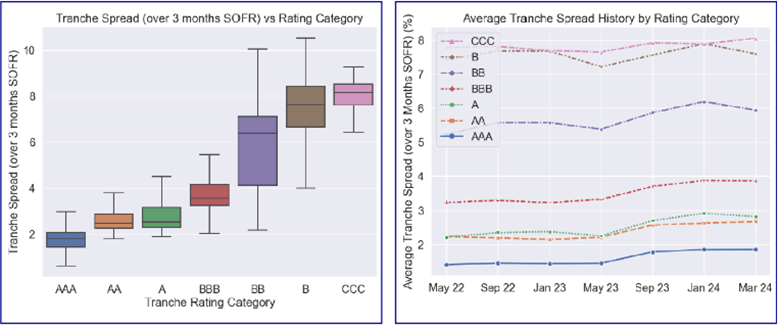

II-C. Tranche Spread Analysis

![]()

The average spread (over 3 months SOFR) of senior tranches and mezzanine tranches are 1.5% and 3.9%, respectively. The 25th, 50th, and 75th percentiles of senior tranche spread (over 3 months SOFR) are 1.3%, 1.4%, and 1.6%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche spread (over 3 months SOFR) are 2.1%, 3.1%, and 5.8%, respectively.

The mean, 25th, 50th, and 75th percentiles of the available spread (over 3 months SOFR) of each rating category (includes +/-) can be found in the table above.

II-D. Egan-Jones Ratings vs Other Agencies

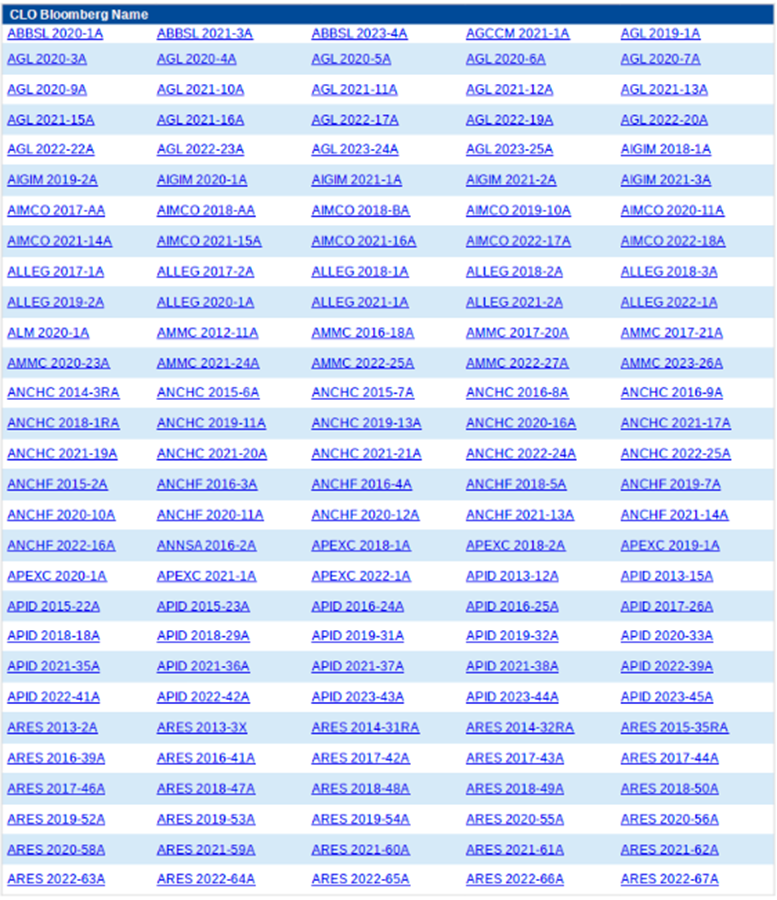

Below is a summary of Egan-Jones ratings compared with other agencies. For the detailed full listing and sorting of Egan-Jones’s CLO ratings, please visit our website at https://portal.egan-jones.com/client/fast/clo.aspx.

Egan-Jones's Key Rating Features & Differences Compared With Others

Below is a summary of Egan-Jones's approach (see our Methodology for a more complete description):

1. Our rating is derived from estimated losses.

2. The probabilities of default utilized are generally more conservative than industry standards.

3. Generally, our ratings are more heavily model driven and take into account fewer subjective assumptions.

4. Generally, we updates the cashflow and ratings monthly based on the availability of the trustee reports.

5. Our analysis is conducted using information and cash flow engines supplied by a recognized industry provider.

III. Pool Asset Key Metrics Summary

This section summarizes the characteristics of the underlying loans in the CLO deals.

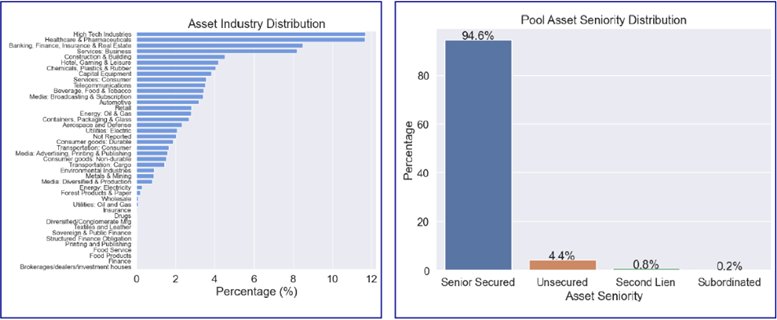

III-A. Asset Distribution

III-B. Asset Coupon Analysis

![]()

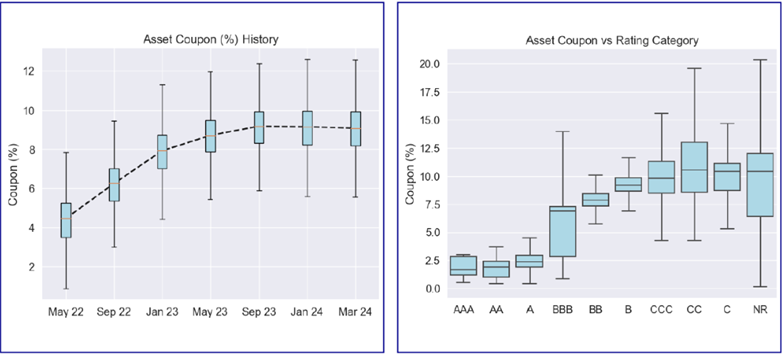

III-C. Asset Rating Analysis

![]()

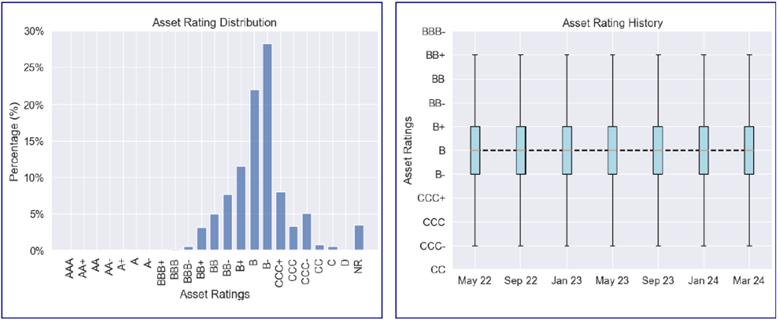

III-D. Asset Default Analysis

Notes

Adj asset coupon means gross asset coupon minus the asset estimated losses which is assumed 50% of loss given default.

Weighted Average Rating Score is derived from 10-year default rate and used to calculate the weighted average default probability of the portfolio.

Diversity Score represents the number of independent, identical assets that we can use to mimic the default distribution of the actual portfolio.

Tranches Subordination is calculated as (Collateral Value - (Pari-Passu Balance + Senior Balance)) / Collateral Value. Defaulted assets are valued at market value.

For more details, please refer to Egan-Jones's CLO methodology.

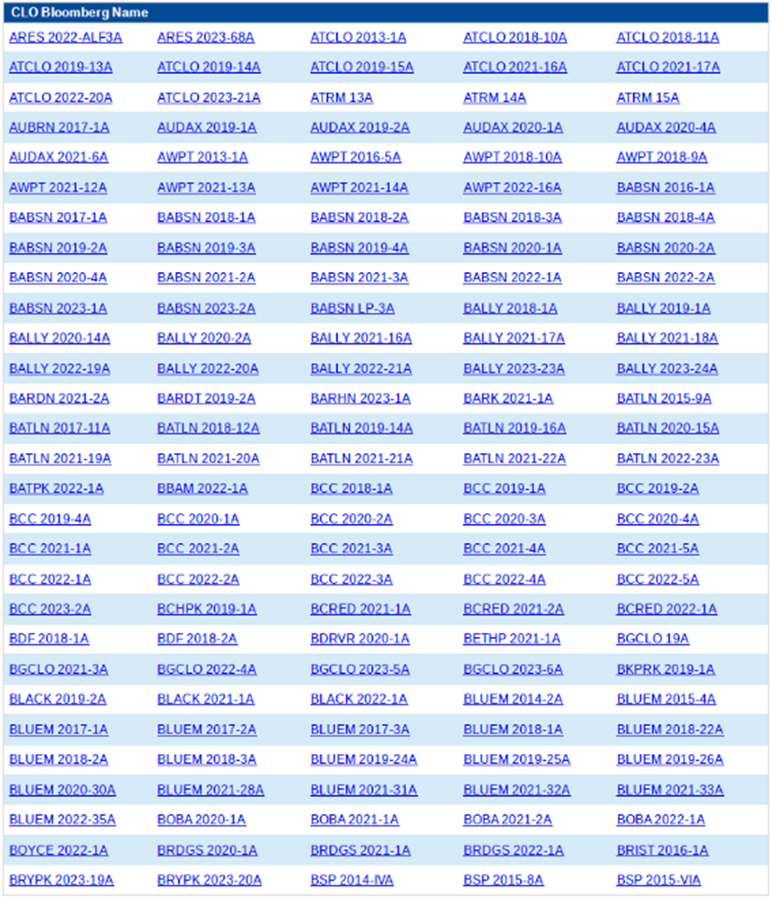

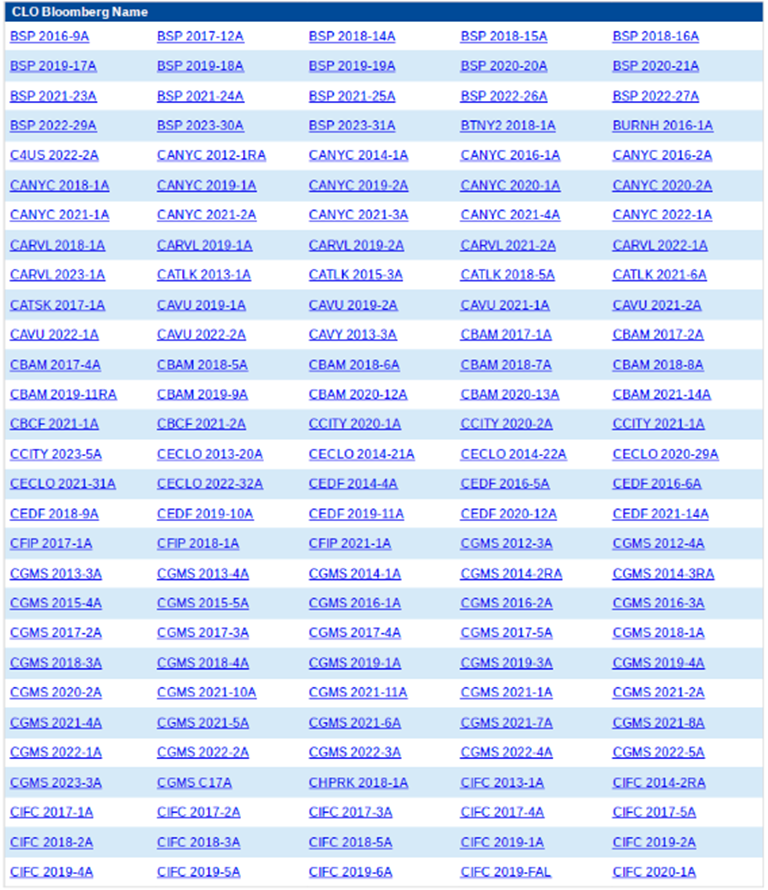

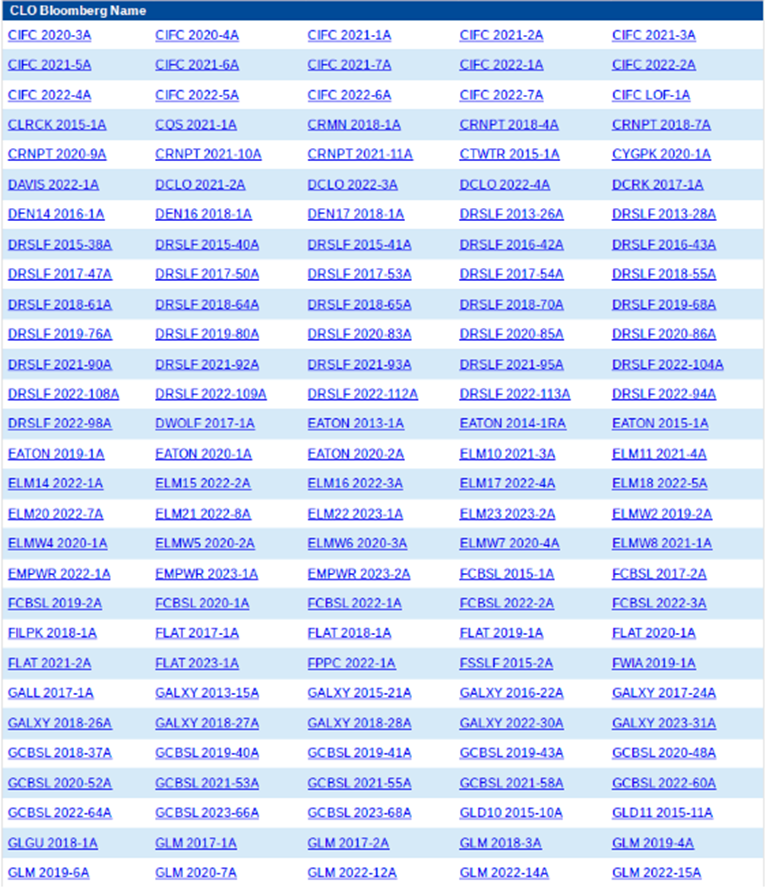

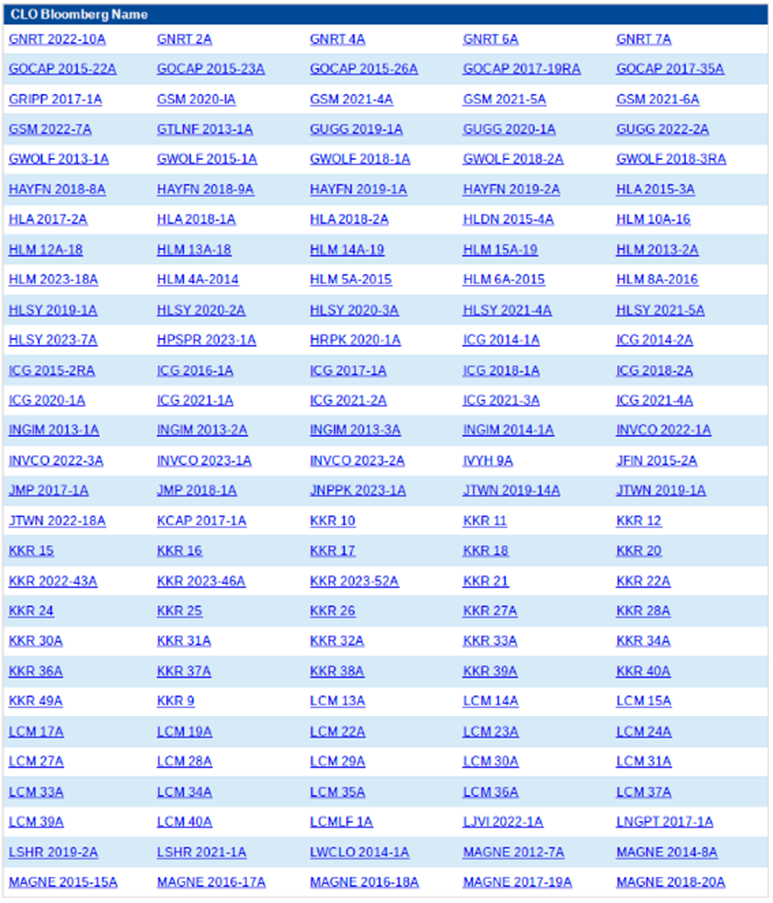

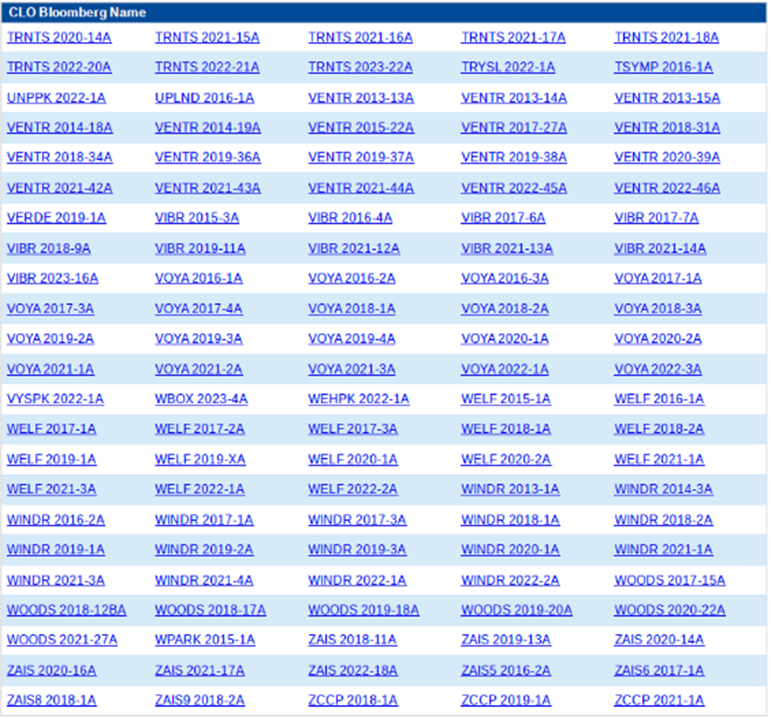

Appendix

Links to Egan-Jones CLO reports: https://portal.egan-jones.com/non-nrsro-ratings/clo

![]()