Egan-Jones CLO* Summary Report (December 2022)

Egan-Jones CLO* Summary Report (Dec 2022)

*Egan-Jones' ratings in this report are not issued under an NRSRO license

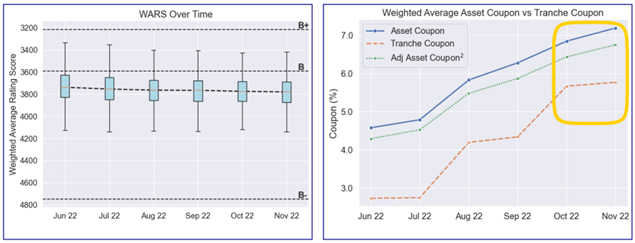

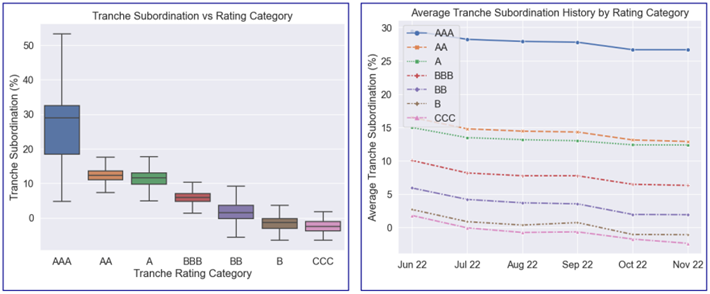

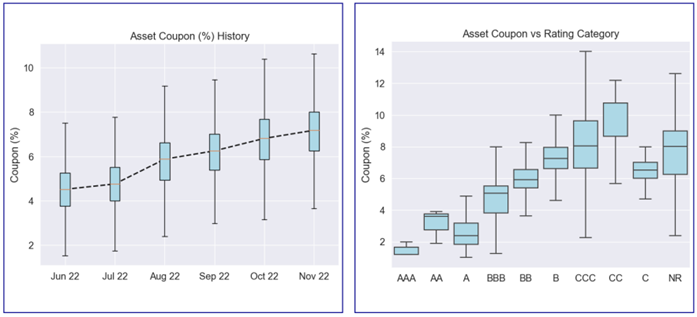

More comfort. The moderation of the Tranche Coupon (orange line) in the chart to the right below suggests that capital providers are moderating their needed yield relative to the Asset Coupons (the blue line). Additionally, BBBs are trading near SOFR + 600bps at a 2% discount, translating into a near 10% yield. Given the BBB 7% subordination (see chart II-A below) and the 50% recovery rates, approximately 14% of the portfolio could default before losses attach. A large rating firm expects the LSTA Leveraged Loan Index Base Case default rate to rise from less than 1.0% to 1.75%¹, which still provides significant cushion for the BBBs.

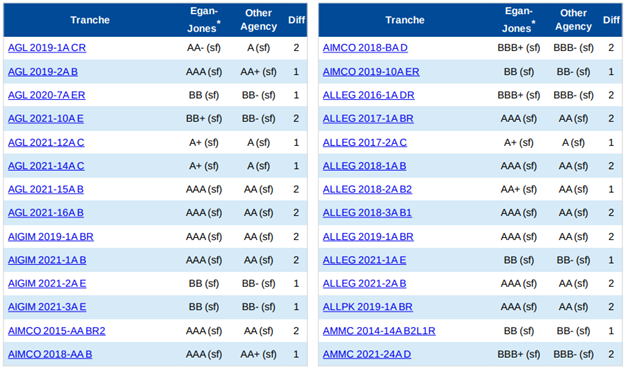

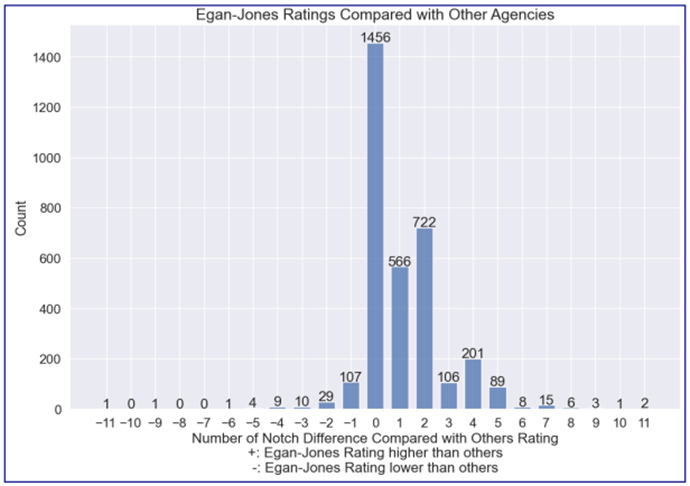

Currently, Egan-Jones tends to have a more positive view of CLO credit quality as compared to other credit rating agencies, as demonstrated in the table below.

I. Deal Key Metrics Summary

As of November 2022, Egan-Jones rated 979 CLO deals. We collected and calculated available deal level, tranche level and asset level key metrics such as deal weighted average rating factor and tranche subordinations, compared with prior period(s) analysis results and summarized highlights below

I-A. Weighted Average Rating Score

Egan-Jones collected the weighted average rating score (WARS)³ of covered CLO deals. The 25th, 50th, and 75th percentiles of the WARS value were 3688, 3779, and 3873, respectively. Egan-Jones calculated and compared the monthly average value of WARS data from June 2022 to this month. The mean value of WARS has increased over the observed period, which indicates the overall default risk might be increasing.

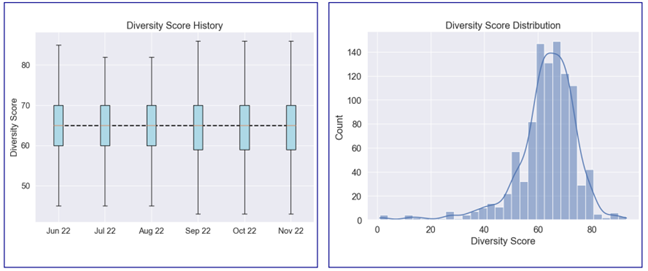

I-B. Diversity Score

Egan-Jones collected the Diversity Score (DS)⁴ of covered CLO deals. The 25th, 50th, and 75th percentiles of the DS value were 59, 65, and 70, respectively. Egan-Jones calculated and compared the monthly average value of DS data from June 2022 to this month. The mean value of DS was stable during the past months.

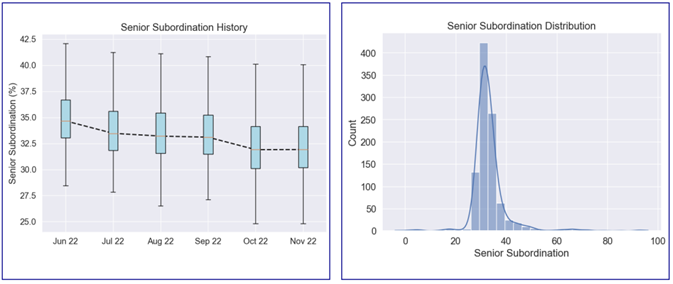

I-C. Super Senior Tranches Subordination

Egan-Jones collected the senior tranches subordination⁵ (%) (STS) of covered CLO deals. The 25th, 50th, and 75th percentiles of the STS value were 30.2, 31.9, and 34.1, respectively. Egan-Jones calculated and compared the monthly average value of STS data from June 2022 to this month. The mean value of STS has decreased over the observed period, which indicates the average senior tranche subordination might be decreasing.

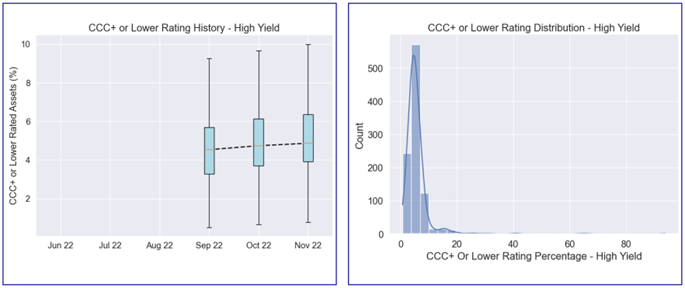

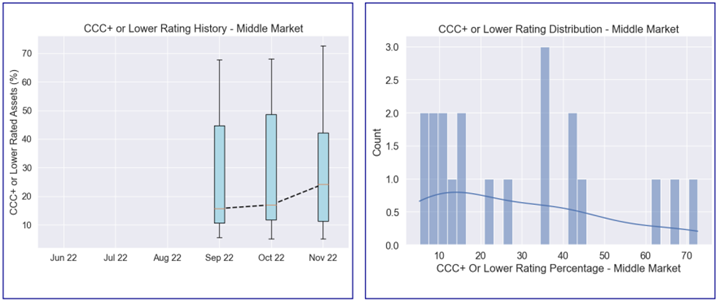

I-D. CCC+ or Lower Rating Percentage

Egan-Jones collected the CCC+ and Lower Rated Asset Percentage (%) (CLRA) of covered CLO deals. The 25th, 50th, and 75th percentiles of the CLRA value were 3.9, 4.9, and 6.4, respectively. Egan-Jones calculated and compared the monthly average value of CLRA data from June 2022 to this month. The mean value of CLRA has increased over the observed period, which indicates the percentage of lower rated assets might be increasing.

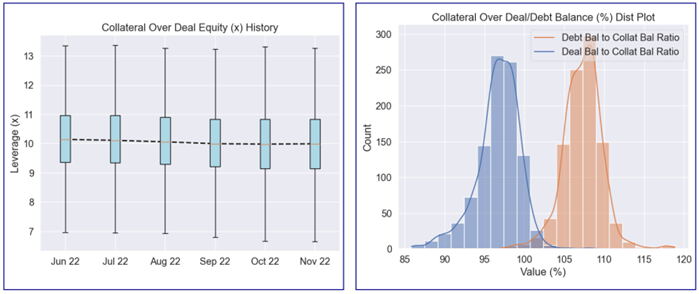

I-E. CLO Leverage Summary

Note: Deal balance is the sum of current balance of all deal tranches; Debt balance is the sum of current balance of all debt tranches.

Egan-Jones reviewed various liability / asset metrics. The 25th, 50th, and 75th percentiles of the total deal balance to collateral balance (total current tranches balance / current collateral balance) were 95.0%, 97.0%, and 99.0%, respectively. The 25th, 50th, and 75th percentiles of the debt balance to collateral balance (current non-equity tranches balance / current collateral balance) were 106.0%, 107.0%, and 109.0%, respectively.

II. Tranche Key Metrics Summary

II-A. Tranche Subordination Analysis

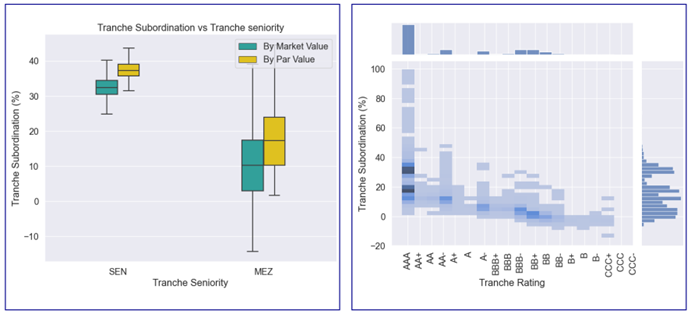

The average subordination levels (defaulted assets at market value) of senior tranches and mezzanine tranches tranches were 33.4% and 10.7%, respectively. The 25th, 50th, and 75th percentiles of senior tranche subordination levels (defaulted assets at market value) were 30.5%, 32.4%, and 34.5%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche subordination levels (defaulted assets at market value) were 2.9%, 10.3%, and 17.4%, respectively.

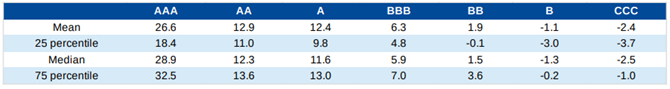

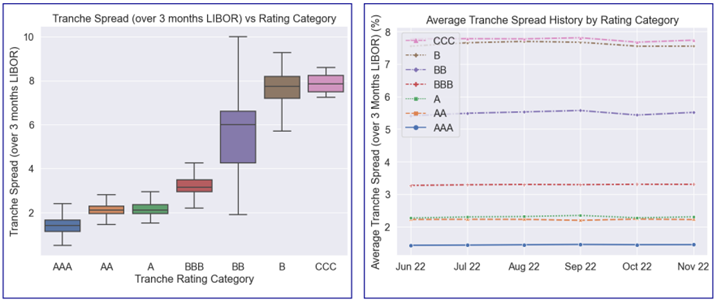

The mean, 25th, 50th, and 75th percentiles of the available subordination of each rating category (includes +/-) can be found in table above.

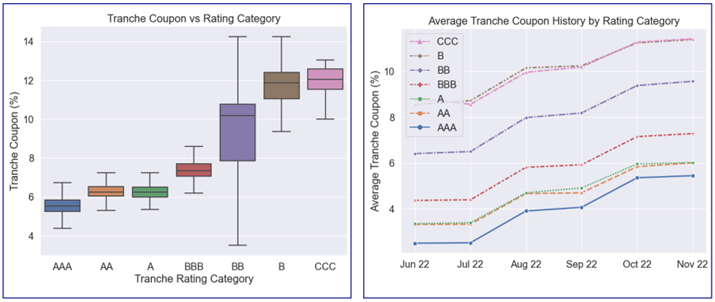

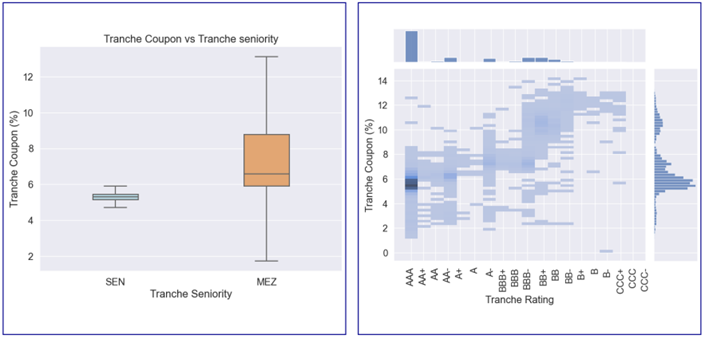

II-B. Tranche Coupon Analysis

The average coupon of senior tranches and mezzanine tranches are 5.1% and 7.3%, respectively. The 25th, 50th, and 75th percentiles of senior tranche coupon are 5.1%, 5.3%, and 5.4%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche coupon are 5.9%, 6.6%, and 8.8%, respectively.

The mean, 25th, 50th, and 75th percentiles of the available coupon of each rating category (includes +/-) can be found in the table above.

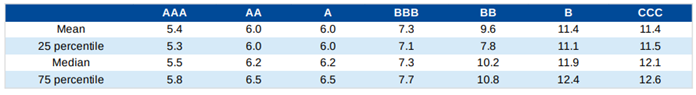

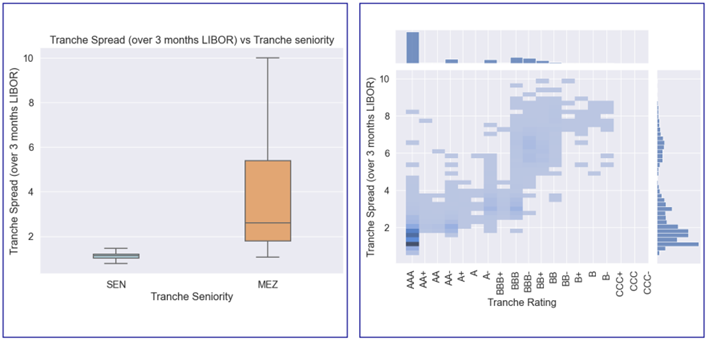

II-C. Tranche Spread Analysis

The average spread (over 3 months LIBOR) of senior tranches and mezzanine tranches are 1.1% and 3.4%, respectively. The 25th, 50th, and 75th percentiles of senior tranche spread (over 3 months LIBOR) are 1.0%, 1.1%, and 1.2%, respectively. The 25th, 50th, and 75th percentiles of mezzanine tranche spread (over 3 months LIBOR) are 1.8%, 2.6%, and 5.4%, respectively.

The mean, 25th, 50th, and 75th percentiles of the available spread (over 3 months LIBOR) of each rating category (includes +/-) can be found in the table above.

II-D. Egan-Jones Ratings vs Other Agencies

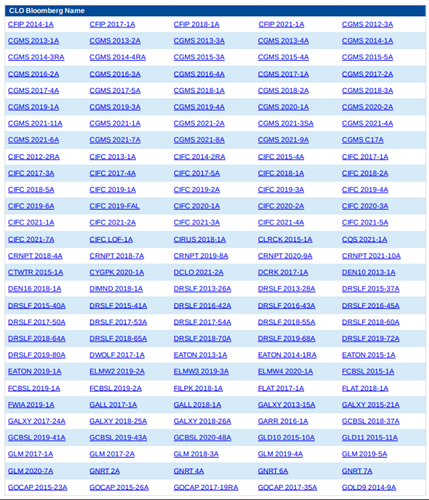

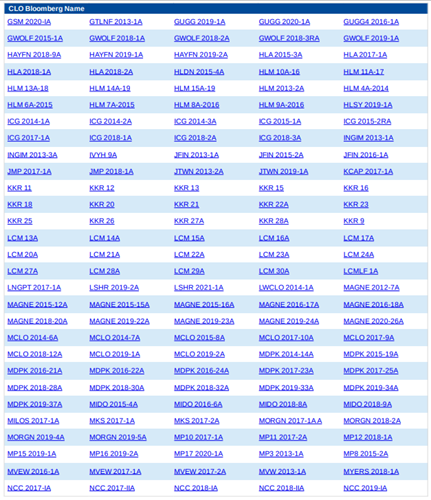

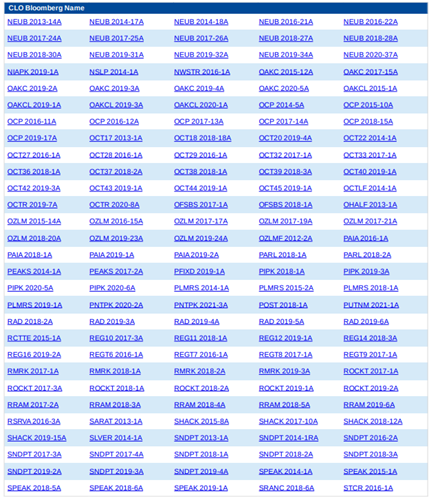

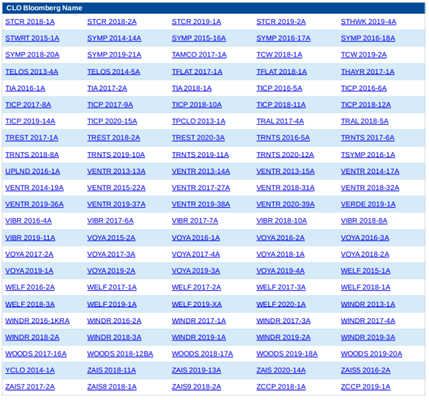

Below is a summary of Egan-Jones ratings compared with other agencies. For the detailed full listing and sorting of Egan-Jones’s CLO ratings, please visit our website at https://portal.egan-jones.com/client/fast/clo.aspx.

Egan-Jones's Key Rating Features & Differences Compared With Others

Below is a summary of Egan-Jones's approach (see our Methodology for a more complete description):

1. Our rating is derived from estimated losses.

2. The probabilities of default utilized are generally more conservative than industry standards.

3. Generally, our ratings are more heavily model driven and take into account fewer subjective assumptions.

4. Generally, we updates the cashflow and ratings monthly based on the availability of the trustee reports.

5. Our analysis is conducted using information and cash flow engines supplied by a recognized industry provider.

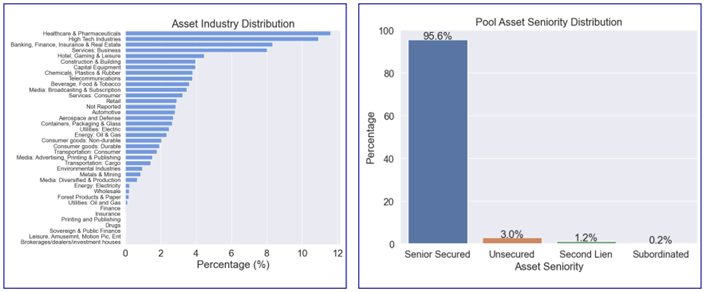

III. Pool Asset Key Metrics Summary

This section summarize the characteristics of the underlying loans in the CLO deals.

III-A. Asset Distribution

III-B. Asset Coupon Analysis

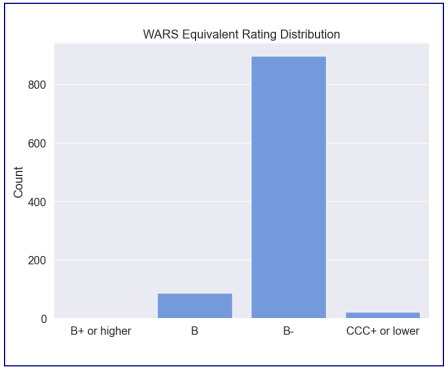

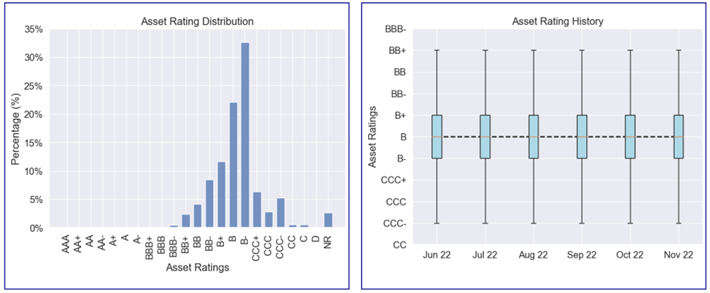

III-C. Asset Rating Analysis

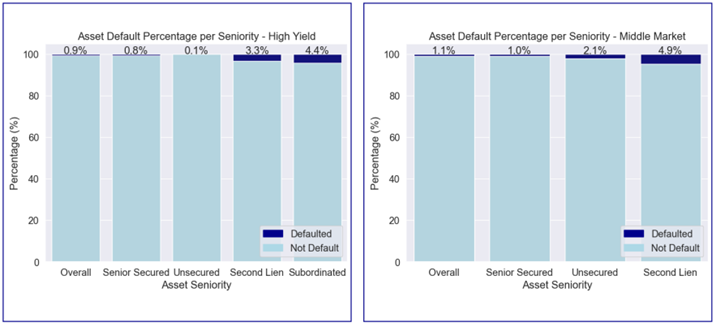

III-D. Asset Default Analysis

Notes

1. U.S. BSL CLO And Leveraged Finance Key Themes

2. Adj asset coupon means gross asset coupon minus the asset estimated losses which is assumed 50% of loss given default.

3. Weighted Average Rating Score is derived from 10-year default rate and used to calculate the weighted average default probability of the portfolio.

4. Diversity Score represents the number of independent, identical assets that we can use to mimic the default distribution of the actual portfolio.

5. Tranches Subordination stands for the percentage of capital subordinated to the current tranche.

For more details, please refer to Egan-Jones's CLO methodology

Appendix

Disclaimer

The information in this report is based on current publicly available information that Egan-Jones considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates, and forecasts contained herein are as of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones’ current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones’ published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and Egan-Jones does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw, or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY- RECOGNIZED STATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKED SECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIES ISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWS AND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUED BY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDED SECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality, or content of, such third-party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted, or distributed in any form without the prior written consent of Egan-Jones. © 2022, Egan-Jones Ratings Company. All rights reserved.

How we can help

Egan-Jones Ratings Company started providing ratings in 1995 for the purpose of issuing timely, accurate ratings. EJR is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider. EJR is certified by the European Securities and Markets Authority (ESMA) and recognized as market leader in Private Placement ratings. EJR also provides independent credit rating research, Climate Change / ESG scores, and Proxy research and recommendations.

Prospective clients have often asked how we can help them and what areas we consider are particularly

strong. In response, below are the areas worth reviewing:

Private Placement Ratings – assisting investors access private markets via ratings on private placements.

Subscription Ratings – we have had a strong track record in providing early, accurate independent credit

rating research.

Climate Change / ESG Scores – an assessment of entities’ current and prospective scores.

Independent Proxy Research and Recommendation/Voting – assisting fiduciaries in fulfilling their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.