Accidents Waiting to Happen (Oct. 4, 2023)

Outcomes often appear random, but closer analysis indicates that many were predictable. This latest installment includes those cases whereby we believe (i) changes are likely and (ii) the impact is material.

I. War Tax

The war in Ukraine has supposedly cost over $160B to date. In our view, the real number is likely far higher. Just as the Marshall Plan was enacted to stabilize Europe post World War II, a similar plan is likely to be enacted after an armistice in Ukraine. In fact, the rebuilding effort is likely to be more expensive than the actual war.

Debates will be held over the next century on the underlying causes of the war, but such analysis is somewhat moot given that the United States is highly engaged and is the main contributor towards the effort. The underlying premise of the war appears to be that Russia could not tolerate a further expansion of NATO, particularly on its border, and that NATO could not tolerate a de facto expansion of Russia.

The current status appears to be slow progress by Ukraine but at the cost of massive support from the West. Given the reluctance of some in Washington to further fund the effort, settlement talks might not be far off. Pressure to reduce funding of Ukraine has likely been exacerbated by the recent ousting of McCarthy as Speaker of the House.

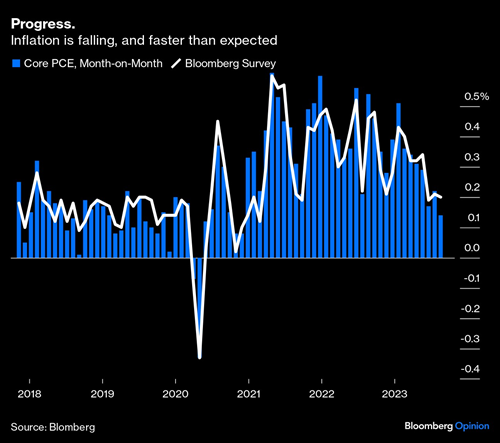

Figure I: US Aid Comparison

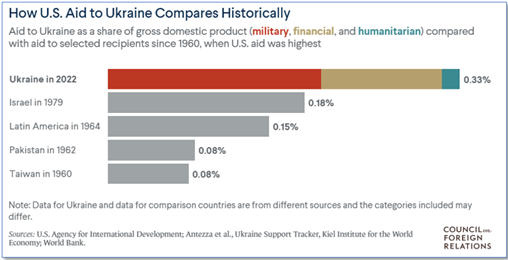

Figure II: Bilateral Aid Commitments

II. Surging Energy Costs

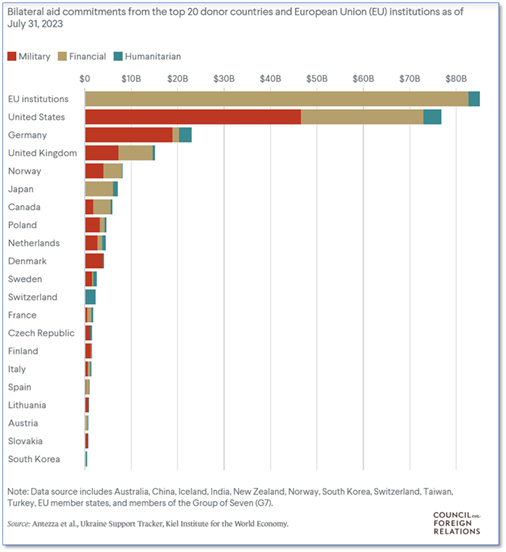

As can be seen in the below chart, petroleum (WTI) prices have risen from $70 to nearly $94 over the past several months. Despite efforts to shift to renewables, carbon-based energy remains embedded in much of the economy and increased prices are bound to track through to inflationary pressures. The increases might remain until the Ukraine conflict is resolved.

Figure III: U.S. West Texas Intermediate Crude Oil Futures

Our View: Mr. Trump will continue to generate headlines and Mr. Biden’s team will focus on winning the election.

III. Auto Shifts/ Possible Strategic Dead End

The UAW is striking strategically important North American manufacturing facilities in the hope of garnering substantial compensation increases. However, the “Elephant in the Room” is the fact that Tesla, and soon other manufacturers, have substantially lower production costs than the three major U.S. manufacturers. These challengers are likely to further reduce costs via the introduction of improved manufacturing processes (i.e., the Giga press which reduces the number of parts required for the undercarriage.)

Assuming the legacy U.S. manufacturers continue to push electric vehicles (on which they lose money), each additional electric vehicle sold cannibalizes profits from profitable internal combustion engine vehicles. Increases to battery range and improved infrastructure are likely to further accelerate the shift in auto manufacturing.

IV. Rising Interest Rates / Helicopter Money

Dr. Bernanke was proclaimed to be an authority on the Great Depression and believed an underlying policy mistake of the government at the time was its reluctance to replace the fleeting demand from the private sector with stimulus from the public sector. Dr. Bernanke stated that he would drop money from helicopters if needed to stimulate demand. As a result of Dr. Bernanke’s proclamations, he earned the sobriquet of “Helicopter Ben.” To address the slowdown related to covid lockdowns, many governments gave away funds to stimulate spending. The problem with found money is that people treated it as such and spent the funds thereby increasing demand and stoking inflation. Hence, while the most immediate problem of tepid demand is solved, it creates the dual problems of inflation and increased sovereign indebtedness, which is exactly what we are facing currently.

Our fear is that as the increase funding costs flows through the system, businesses and consumers will have increasing trouble servicing debt. On the positive side, debt providers are realizing stronger real returns than they have in years

Figure IV: Inflation Breakeven and Real Yield

V. China

The misguided hope of Dr. Kissinger and President Nixon was that as China opened, it would become more like the Western nations and adopt their values. There were encouraging signs along these lines with Chou Enlai’s comments that a cat can be any color as long as it caught mice, meaning that some of the hardline Marxist attitudes could be suppressed if it helped China’s development.

Unfortunately, things did not work as planned and China is now struggling with little to no population growth, massive debt issues, and restriction in various commercial areas. An invasion of Taiwan remains a concern; unaddressed is the possibility that the PRC has many thousands of agents in key positions in Taiwan ready to act when conditions are propitious. There is talk that Xi Jinping is less interested in the country’s economic development than his historical standing, thereby raising the Taiwan issue as possibly a more immediate concern.

Epilogue

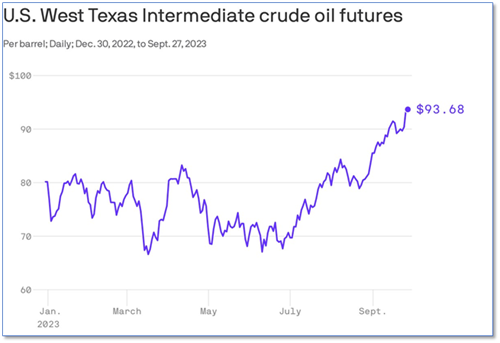

Pessimism is easy to adopt, but often the most attractive investment returns are realized by looking past current problems. A major positive is the decline in reported inflation (see below). Elevated long-term interest rates may reflect expectations of additional rate increases. The Fed's and China's intention to reduce their US Treasuries as debt issuances increase may also elevate long-term rates. Nonetheless, we would not be surprised if markets calm over the next six months.

Figure V: Inflation Rates