Conestoga Conundrum, Assassin in our Midst (Feb. 12, 2024)

Overview

Automobiles are a major segment for most developed countries and are currently undergoing massive changes.

Cybertruck beats Porsche 911 in epic drag race whilst towing Porsche 911¹

Significant Breakthrough I

As of a few decades ago a common retort was “What is good for GM is good for the country”. The notion was that the company’s and country’s interests were closely aligned and that the prosperity of one led to the prosperity of the other.

Our view is that the auto manufacturing industry is undergoing sweeping changes and will look very different by the end of the decade if not sooner.

One of the major catalyzing developments is the introduction of the Cybertruck and shortly the Next Generation (NextGen) vehicles. In the case of the Cybertruck, it is priced competitively with the leading truck brands, but is expected to be far less expensive to operate and more durable. The usage of a stiff unibody composed of stainless steel, drive by wire, and a shift to a 48-volt system, are likely to prove far more attractive to vehicle owners than offerings from other firms².

A milestone was reached with the casting of the bulk of the undercarriage via the gigapress, which has the potential for massive cost savings. Watch for significant price reductions over the next couple of years.

Significant Breakthrough II

While the release of the Cybertruck is impressive, the more relevant fact is likely to be the technology used in the production process, which is expected to enable the NextGen vehicle to be priced near $25K (before tax credits). Given the projected price point, travel range, and vehicle features, NextGen is likely to have a massive and broad audience.

Significant/ Why it Matters

The domestic automakers make most of their money on truck sales with the leading manufacturer, Ford, selling 700k new F-series trucks in 2023³ . Tesla is expected to produce 260k CyberTrucks in 2025⁴. Regarding the NextGen vehicle, it is likely to become a massive seller, ultimately outpacing Model 3, which is expected to reach a total of 700k units produced by early 2025⁵.

For all the progress Tesla has made, BYD is producing even more vehicles and is likely to place additional pressure on the traditional manufacturers. These developments have already impacted some of the legacy manufacturers with Volkswagen announcing a $10.9bn cut in costs⁶, leaving little room for new development. Assuming the average new vehicle costs near $45k and its useful life is 10 years, car owners are spending an equivalent of $4.5k per annum with auto companies. With two vehicles in the average family, the amount spent per family effectively doubles. Considering spending on spares and repairs, the figure grows more still. Hence, the auto industry is massively important.

Tying it all together

Steve Jobs massively accelerated the growth and profitability of Apple by founding an ecosystem of integrated products and services (e.g., Apple Music, the App Store, iCloud, AirPods, Apple Pay, etc.) and thereby created high costs for users to exit and difficulty for competitors to replicate. Tesla has a similar opportunity. The technology associated with self-driving is massively complex and is likely, over time, to be tied with its Artificial Intelligence efforts, its “X” ecosystem, and other emerging technologies. Tesla with FSD has reduced interventions (i.e., a driver’s having to intervene to prevent and accident) to one per 3.2 million miles compared to traditional accident rates of one every 190K miles⁷. However, unlike Apple, Tesla has retained manufacturing control, which they believe is essential in the product creation process.

Conestoga Conundrum

We used the captioned title for this installment to remind readers of the difficulty many companies have in making major technological shifts. The Conestoga wagon was the premier form of transportation for settlers travelling west in the early days of the country. However, despite the brand’s dominance, it never was a presence in self-propelled vehicles. Likewise, as vehicles shift to a more technology-intensive mode, with self-driving and alternative propulsion systems, it is doubtful that the prior leaders will be the future leaders.

Caveats/ Assumptions

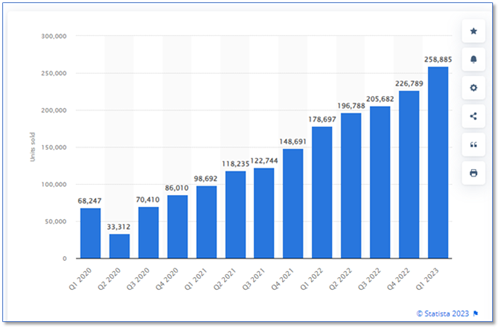

A key assumption is that electric vehicles will continue to gain traction. To date, sales continue to be impressive as shown below:

Battery electric vehicle sales in the United States⁸

Sources

[1] https://supercarblondie.com/cybertruck-beats-porsche-911-drag-race/

[2] https://insideevs.com/news/690829/tesla-cybertruck-production-capacity-260k-units/

[3] https://www.freep.com/story/money/cars/ford/2023/12/28/ford-f-series-…

[4] https://www.youtube.com/watch?v=6RGsp7gaS4w

[5] https://thedriven.io/2023/05/11/tesla-model-2-will-be-small-version-of-…

[6] https://www.reuters.com/business/autos-transportation/volkswagen-…

[7] https://www.youtube.com/watch?v=kCHdYpHwBDk, minute 39.52

[8] https://www.statista.com/statistics/1231872/battery-electric-vehicle-…

This content is produced by individuals who are not part of the credit ratings team and do not have responsibilities for determining credit ratings or developing/approving methodologies, models or procedures that are used to determine credit ratings. The views expressed in this article might not parallel the views of the credit ratings team. The information in this report is based on current publicly available information that Egan-Jones Ratings Company (“Egan-Jones”) considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein areas of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones Rating’s current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones Rating’s published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and EJR does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY-RECOGNIZEDSTATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKEDSECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIESISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWSAND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUEDBY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDEDSECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third-party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality or content of, such third party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of Egan-Jones. © 2023, Egan-Jones Ratings Company. All rights reserved.