Dangerous Assumptions (Aug 24, 2023)

One of the greatest causes of pain (and conversely, gain) are assumptions that prove to be false. Unfortunately, false assumptions are difficult to ascertain as is positioning oneself to maximize returns. Nonetheless, below are our attempts.

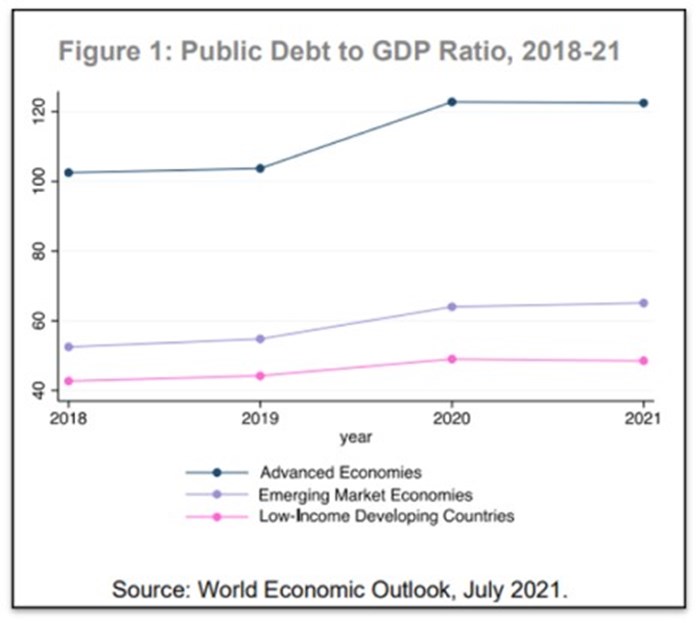

Figure I: Public Debt to GDP Ratio (2018-2021)

I. Sovereign Debt Crisis

Synopsis: Major developed countries’ debt burdens have risen dramatically over the past several decades. Furthermore, the rise in interest rates has placed additional pressure on funding costs associated with servicing debt. The concern is whether countries will reach an inflection point whereby no amount of growth will enable them to absorb the increased funding costs.

Per the IMF, “Debt increases are particularly striking in advanced economies, where public debt rose from around 70 percent of GDP, in 2007, to 124 percent of GDP, in 2020.”[3] (See the above graph.)

Solution: The reality is sovereign governments have massive control over their currencies and in the past have devalued their currencies to make their debt more affordable. Through Antiquity, the preferred solution was to dilute precious metal in their currency.[4] In modern crises, central banks have purchased debt issued by their treasuries; currently, the central banks hold approximately $27 trillion in assets.[5] Furthermore, in an unprecedented action, the government has issued “helicopter money,” cash distributions to the public to stoke demand during the Covid lockdowns. We expect that governments and their treasuries to step up their efforts to forestall any hard default with the upshot being the spreading of pain over years or decades.

Hence, it would be imprudent to rush to conclude credit quality will be impaired due to elevated debt-to-GDP ratios. However, governmental success is temporary; perhaps the UK is paying for prior over-extension.

II. Energy Crisis/ Global Warming

Synopsis: It has been broadly accepted that carbon dioxide emissions have led to greater warming of Earth than would otherwise occur. Despite efforts of the developed countries, less developed countries are emitting significantly; their manufacturing-focused economies are in many ways outsourced carbon dioxide emitters for developed countries.

Solution: In our view, we are at the nascent stages of developing alternative energy sources; even within the next 10 years more palatable energy sources are likely to be accepted. Regardless of changes to energy production and mining, current warming and future warming is already baked in.

Hence, with the current trends in place, some developments might in retrospect be unsound (see Neom and the Line).

III. Water Crisis

Synopsis: Related to the Energy Crisis is the situation whereby vast areas have unstable water sources leading to droughts and flooding. In the past, the problem probably corrected itself as people were forced to live near dependable food supplies. Desert dwelling was difficult, limited, and often temporary.

Solution: If water tables decline and well water is unobtainable, alternative energy-intensive solutions such as water desalination will be necessary. Water-use limits are likely to continue and we are likely to see migration to areas with adequate fresh or desalinated water.

Hence, growth in those areas with restricted water supply will be limited.

IV. Population Crisis

Synopsis: In many developed countries, along with China and Russia, birth rates have declined below replacement rates. These aging societies will soon have few workers relative to retirees. Reasons for the new trend are manifold, including decreasing religious affiliation, new education and career options for women, and relatedly, changing cultural norms.

Solution: Many countries have turned to immigrant labor to replace the hole left by empty new generations, though this presents its own challenges. Technology is likely to help with a variety of tasks, affecting both manual work (such as agriculture, warehouse work, truck and taxi driving, and manufacturing work) as well as office work (such as data entry, research, and document production).

Hence, countries which do not adjust will probably have increasing difficulties meeting their obligations. Near the top of the list is Japan which, while aging, remains skeptical of immigration.

V. Urban Crisis

Synopsis: Shoplifting and sporadic violence is an unwelcome, though common occurrence in many American cities. Conditions in San Francisco have sufficiently deteriorated that Gump’s is considering closing its downtown store, a move already made by some retailers.

Solution: Conditions change when cities slipping into miserable states realize that policies must be adjusted to survive. Examples include NYC with its near bankruptcy in the mid 1970’s and Los Angeles during the Watts riots in the mid 1960’s. Hopefully conditions will improve soon.

Hence, while conditions appear unsalvageable, the relevant parties are forced to work together for the benefit of all.

Sources & Footnotes

[1] National Association of Insurance Commissioners, by permission. The NAIC does not endorse any analysis or conclusions based upon the use of its data. Market share determined by direct written premiums.

[2] The analysis of the NAIC data by Egan-Jones has been validated by RiskSpan, Inc.

[3] https://www.imf.org/en/Blogs/Articles/2021/12/15/blog-global....

[4] https://warwick.ac.uk/fac/arts/classics/intranets/staff/butc...

[5] https://www.yardeni.com/pub/peacockfedecbassets.pdf