Disney: Losing the Magic (Dec. 14, 2023)

Over the past three years, Walt Disney Co.’s (DIS) shares have collapsed from $172.89 (as of Dec. 13, 2020), to merely $91.14 (as of Dec.12, 2023) a decline of 47% while during the same period, the S&P 500 Index (SPX) rose from $3,709 to $4,644, an increase of 25%. Over the past year, DIS has been more or less flat while the SPX has been up near 10%. Furthermore, with rolling four-quarter EPS at $1.28, the current share price of $91.14 constitutes a relatively rich P/E ratio of 71.2x. The fundamental question for shareholders is whether DIS’s management is best suited for protecting and enhancing value or whether a change is in order.

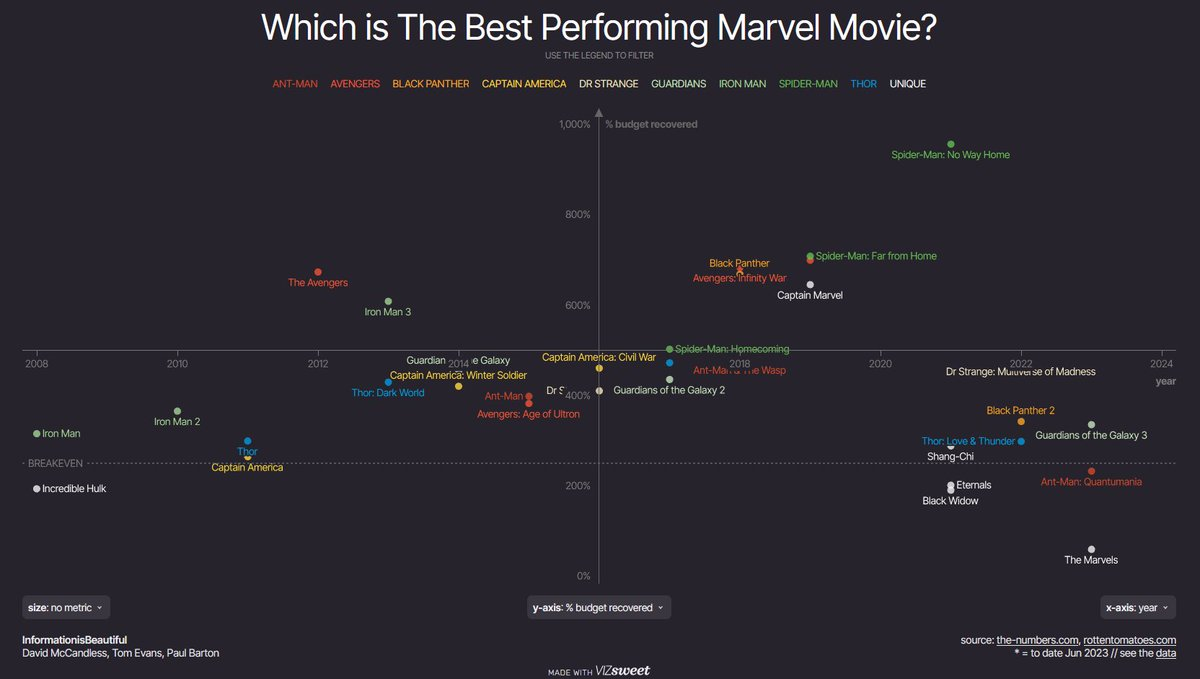

Figure I: Best Performing Marvel Movie

Over the past several decades, DIS has established itself as the global brand for entertainment and media. Major franchises include Disney films and TV, ESPN, ABC, and Disney Parks. There is little question that management has made some mis-steps over the past several years and even under the experienced leadership of Mr. Iger, the company continues to stumble. However, we believe there are some more fundamental problems at play.

Our premise is that the world has changed massively over the past few decades and DIS has not found its footing.

For starters, as a result of the internet, access to entertainment has massively expanded, thus a brand such as Disney, Star Wars, or Marvel, has significantly more competition not only from other video entertainment, but also from gaming and a range of other activities which have evolved over the past couple of decades.

Secondly, the formula of acquiring narrow brands such as Pixar, Star Wars, and Marvel has worked over the past decade in basically institutionalizing those brands and issuing a series of films regularly based on the same characters and themes. However, there are few readily available acquisitions in the wings and the current line-up is becoming dated.

Third, DIS has lost some support of its core audience by taking political stands.

Lastly, brands such as ESPN remain very valuable but are increasingly challenged by sports betting operations, which can derive far more economic benefit from sporting events than mere broadcasters. FanDuel and Draft Kings have within a short period become major sources in all facets of major sporting events. ESPN Bet has yet to gain comparable traction. Additionally, some global distributors such as Amazon and Netflix are bidding on broadcasting rights to the detriment of DIS.

The upshot of the aforementioned developments is that DIS’s margins have collapsed as it tries to compete and of course, earnings have faltered. The issue for senior management is how to best position DIS for a different world that they are now facing. Our view is that the old magic will be hard to recreate and that DIS might consider focusing on core businesses where they have a sustainable competitive advantage. For shareholders, the question is whether the current leadership recognizes the “sea change” they are facing and can make the necessary adjustments.