Emulating Mr. October (Sept 11, 2023)

Reggie Jackson, the superstar slugger for the New York Yankees earned the sobriquet “Mr. October” for his uncanny ability to score runs when the team was desperate. George Steinbrenner, the long-time owner of the Yankees, highly valued a player who could perform in a clutch situation. Likewise, the sophisticated institutional investor and risk manager should have a good handle on some of the major risks and likely outcomes. Below is our summary.

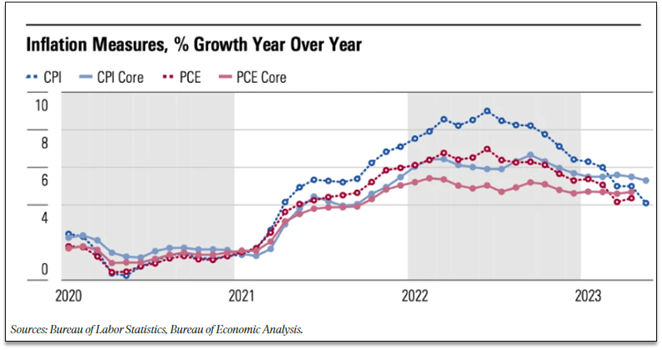

I. Inflation

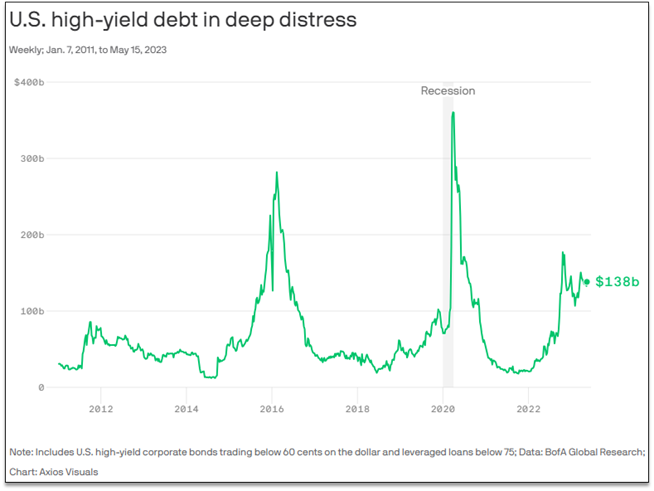

The good news is that inflation appears to be peaking with the latest print near 4.0%, a far cry from the 8+% realized in mid-2023. The bad news is the devastation wrought by the higher rates. The amount of debt trading at distressed levels is up from approximately $30B in late 2021 to $138B on 2023 (see below).

Our View: the Fed is either done or nearly done increasing rates and most of Washington will soon be focused on the 2024 elections which typically translates into a more business-friendly environment.

Figure I: Inflation Measures, % Growth YoY

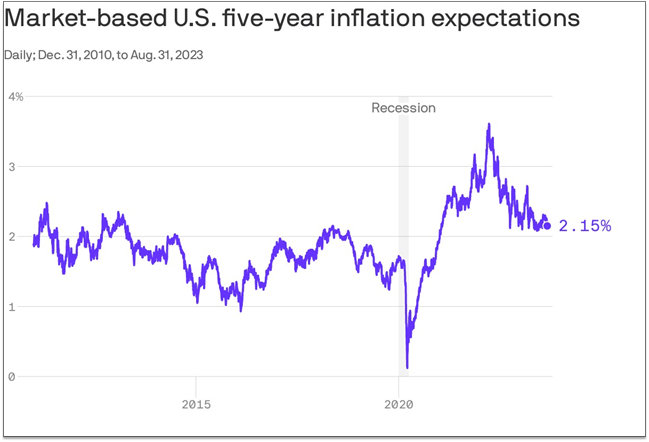

Figure II: Five-Year Inflation Expectations

Figure III: U.S. High-Yield Debt

II. Elections

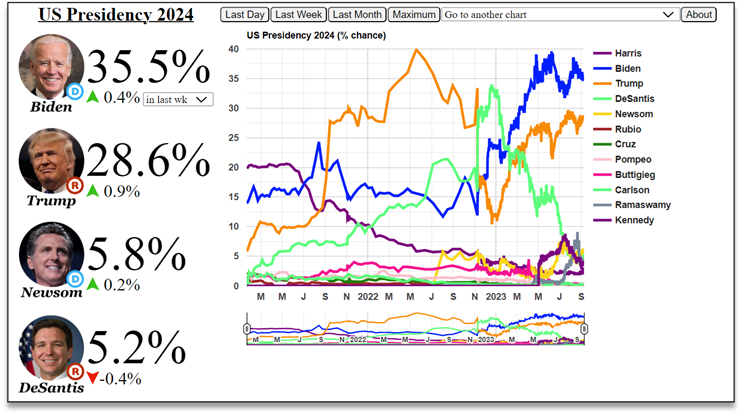

The key issue regarding the election is whether Mr. Trump, who appears likely to win the Republican nomination, will be able to win over enough moderates to win the general election. From our perspective, Mr. Trump appears to have a passionate base of support but continues to have difficulty attracting broader support. On the other hand, Mr. Biden continues to be hounded by the extra-curricular activities of his son and questions on his own age. Time will tell, but the race still appears to be Mr. Biden’s to lose.

The below graph places Mr. Biden with a 36% chance and Mr. Trump near 29% likelihood of winning.

Figure IV: Chance of US Presidency 2024

Our View: Mr. Trump will continue to generate headlines and Mr. Biden’s team will focus on winning the election.

III. China

On the one hand, many consider China to be public enemy number one, with every policy geared to weakening the country (see the push for shifting production away from China, restricting chip sales, limiting student visas, restricting investments, etc.). On the other hand, is the ongoing fear that China’s GDP is weakening, the yuan is weakening, and several sectors are under duress (see the developers and some financial institutions). The flawed assumption in allowing China into the World Trade Organization was that over time, its society would become more like a Western Democracy. In retrospect, it was naïve, and now many companies are rapidly trying to diversify their sourcing. Apple recently has faced pressure through a ban on Chinese government employees using their Apple devices while at work.

If conditions further deteriorate, President Xi might take more desperate measures to distract from domestic ills, which include the yuan's devaluation to 16-year lows.

Our View: China has achieved massive progress over the past couple of decades. Due to tight control over its population, the Chinese government isn't likely to face major domestic opposition. Watch for a redirection of investment away from uneconomic projects to more productive means.

IV. Ukraine

Ukraine has surprised many with its spirited defense and might be on the verge of a breakthrough with a penetration of several defense lines and the real possibilities of severing Russian supply lines. An indication of Ukraine’s success is Mr. Putin’s placing advanced Sarmat nuclear-capable missiles on “combat duty.” If Ukraine achieves a breakthrough, the retaking of Crimea become significantly easier.

Our View: Most involved in the Ukraine War hoped for a rapid ending with perhaps the major obstacle being the pride of Putin and the joy of Ukraine (joy in the possibility of retaking Crimea and other areas lost). We hope that Mr. Putin continues to exercise restraint on the nuclear front and that over time that peace will prevail with the upshot being a resurgence in energy, food, and fertilizer supplies.

V. Europe

Europe’s politics and economy remain complex. To the credit of the Biden administration, it has united both European and Asian/Australian allies against common enemies and revitalized NATO. The Ukraine war and the constraints on China have been vastly expensive, but the alternative would likely have been more costly. The coming winter is likely to be colder than the last, but Europe and its allies have had time to prepare. Perhaps a result of Russia’s difficulties is a reduction in the probability that China attacks Taiwan.

Our View: Our hope is that conditions improve over time.

Sources & Footnotes

[1] https://electionbettingodds.com/President2024_week.html

[2] https://www.aljazeera.com/news/2023/9/2/russia-puts-advanced...