False Prophets and False Prophesies (Mar 13, 2024)

Overview

As a risk manager or manager of institutional capital, it is critical to have a firm grasp on major challenges and likely outcomes. Building and maintaining a portfolio based on false assumptions can be disastrous.

To make this installment as useful as possible, we aim to address some of the underlying assumptions making the rounds in the markets.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

-Mark Twain

“An economist is a portfolio manager who never marks to market.”

-Howard Marks

I. Hard Landing

For the past four years (i.e., since the 2019 Covid Outbreak) many have been predicting a hard recession due to the length of the prior recovery and the stress on the economy from lockdown. To the dismay of the distressed investors, the stress period lasted approximately 40 days and has not reappeared since.

Commentary: Yes, the government’s providing support via a variety of programs has helped, but that is only a partial explanation. Perhaps a more relevant factor is the incredible resilience of the economy stemming from the relentless pace of innovation in the form of AI (Artificial Intelligence) and constantly improved software and services.

II. Inflation Scare

As of 18 months ago, many were bemoaning the level of inflation and the rapid rise of Fed funds rates. More recently, inflation has eased and 10-year treasuries have assumed more moderate levels.

Commentary: While consensus on the underlying cause of inflation remains elusive, the most plausible explanation appears to be that proffered by Lacy Hunt. His view is basically a twist on Milton Friedman’s stance; inflation is caused by currency creation in excess of the real growth of the economy. Given that measure, inflation should moderate over time.

III. Japan’s Elevated Debt Levels

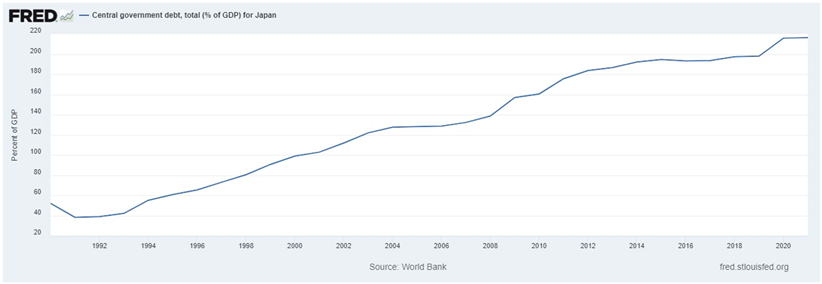

Japan has sovereign debt to GDP in excess of 200% which places it at the top of the developed world (the US’s is now near 120%)¹.

Figure I: Japan's Central Government Debt (% of GDP)

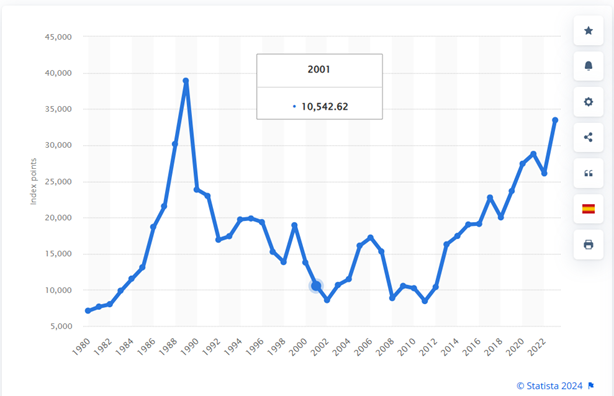

Nonetheless, Japan was one of the top performing markets over the past 10 years (see below).

Figure II: Annual Performance of Nikkei 225 Index Annual Performance from 1980 to 2023

Commentary: A key issue for assessing the danger poised by debt levels is to whom is the money owed and how are the governments deficits being funded. The reality is that Japan funds much of its debt via internal sources and therefore does not have to tap the international markets for funding. The Bank of Japan holds 53% of Japanese government debt². Hence, it is less subjected to the discipline of the capital markets. Regarding the performance of the stock market, Japan has benefitted from the shifting away from China as a supply base and from the avoidance of a recession.

IV. China’s Demise

Several political scientists have predicted the imminent demise of China based first on the Covid lockdown slowdown, then on the curtailment of orders based on security concerns, and now on threatened shipping links. The massive over-building and developer defaults remain a concern. Perhaps an underlying wish is one of a regime change.

Commentary: Our view is that regime changes are extremely difficult and that like Russia, China can and will endure great hardship if needed to survive. Perhaps the best example is Huawei’s rapid introduction of an advanced phone after chip exports were cutoff. Another positive is the emergence of Chinese auto manufacturers such as BYD, which appears to be on track to becoming the global leader and apparently is capable of producing an $11,000 credible vehicle (see below).

IV. China’s Demise

Over the period of written history, progress has been coupled with an increase in population; a prosperous society was a growing society. Look no farther than the typical annual report which emphasizes growth as equating with success. In contrast, many rural areas are faced with population busts whereby it appears to be only a matter of time before towns disappear.

Commentary: To a certain extent, we a treading on covered ground with Malthusian arguing that the world’s resources were limited and that it best we curtail growth lest we run out of resources. Currently, there is a different twist on the same issue whereby the fertility rate in developed countries is typically below the replacement rate. Coupled with these developments is the concern that the various social security/pension and healthcare programs will run out of funding.

Our view is that while adjustments will be painful, they will be doable and that over time people will rethink their views. For example, it is likely that self-driving trucks and vehicles will reduce the need for some workers as will robots and other machines equipped with AI.

Sources

[1] https://fred.stlouisfed.org/series/GFDGDPA188S

[2] https://www.nippon.com/en/japan-data/h01720/

This content is produced by individuals who are not part of the credit ratings team and do not have responsibilities for determining credit ratings or developing/approving methodologies, models or procedures that are used to determine credit ratings. The views expressed in this article might not parallel the views of the credit ratings team. The information in this report is based on current publicly available information that Egan-Jones Ratings Company (“Egan-Jones”) considers reliable, but we do not represent it is accurate or complete, and it should not be relied on as such. The information, opinions, estimates and forecasts contained herein areas of the date hereof and are subject to change without prior notification. Any credit ratings issued by Egan-Jones represent Egan-Jones Rating’s current opinion of the credit risk of the instrument or entity rated. Any such credit ratings do not address other factors or risks such as market volatility, market risk or liquidity risk. Prospective clients should refer to Egan-Jones Rating’s published statements as to the meaning of different credit ratings assigned by Egan-Jones. Credit ratings provided by Egan-Jones are solely intended to be used by institutional investors. Egan-Jones does not assess or address the suitability of any investment for any client or any other person or the marketability of any security or instrument. Any credit rating issued by Egan-Jones is not, and should not be construed as, a recommendation to buy, sell or hold any security or instrument or undertake any investment strategy and EJR does not act as a fiduciary for any person. Egan-Jones may raise, lower, suspend, withdraw or otherwise modify a credit rating at any time in its sole discretion. EGAN-JONES IS NOT LICENSED AS A NATIONALLY-RECOGNIZEDSTATISTICAL RATING ORGANIZATION (“NRSRO”) IN RESPECT OF “ASSET-BACKEDSECURITIES”, “GOVERNMENT SECURITIES”, “MUNICIPAL SECURITIES” OR SECURITIESISSED BY A FOREIGN GOVERNMENT (ALL AS DEFINED IN THE FEDERAL SECURITIES LAWSAND, COLLECTIVELY, THE “EXCLUDED SECURITIES CATEGORIES”) AND ANY RATING ISSUEDBY EGAN-JONES IN RESPECT OF ANY SECURITIES FALLING WITHIN AN EXCLUDEDSECURITIES CATEGORY IS NOT ISSUED BY EGAN-JONES IN ITS CAPACITY AS AN NRSRO. Egan-Jones is not responsible for the content or operation of third-party websites accessed through hypertext or other computer links, cannot guarantee the accuracy of any information provided on an external website and shall have no liability to any person or entity for the use of, or the accuracy, legality or content of, such third party websites. The views attributed to any third party, including any article accessed via computer links, do not necessarily reflect those of, and are not an official view or endorsement of, Egan-Jones. This publication may not be reproduced, retransmitted or distributed in any form without the prior written consent of Egan-Jones. © 2023, Egan-Jones Ratings Company. All rights reserved.