Goldilocks Environment; The Inflation Witch; Ukraine Update; Super Cycle (Feb 2023)

Risk Commentary

Goldilocks Environment; The Inflation Witch; Ukraine Update; Super Cycle (Feb 2023)

Announcement: 2022 was a record year for Egan-Jones Ratings. The firm continued to cement its position as the leader in private debt ratings by issuing approximately 2,700 ratings - more than in any prior year. Our performance statistics continue to demonstrate our favorable default experience in 2022. Only one of our rated transactions in 2022 defaulted. It was previously rated CCC+. This was similar to prior years' default experience.

Goldilocks Environment

Seth Klarman, chief executive of the Baupost Group, is one of the three investors who Warren Buffett would invest with if Berkshire Hathaway disbanded. Klarman has stated that investing involved the intersection of financial analysis and psychology. The psychology part appears to be dominating currently as conditions are particularly attractive in private debt. Hence, our term the “Goldilocks Environment.”

The yield on both new and floating rate investments has risen due to increasing treasury rates and some spread increases. The issue is if yields have risen sufficiently to offset estimated losses. For now, it appears they have.

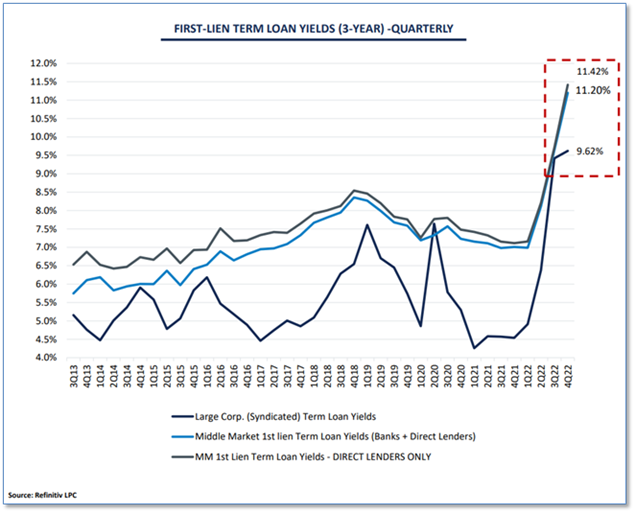

As central banks focus on market stability, we have doubt that losses will rise to offset the benefits of increased yields. Hence, we consider the current environment as “Goldilocks” and is likely to dissipate as the FED moderates rate increases. The below chart suggests that yields have risen 450 bps or more over the past year.

Figure I: First-Lien 3-Year Term Loan Yields (% per Quarter)

One of the major rating firms estimates that default rates will rise to 2.0%, and 4.25% in the pessimistic case.

Among rated loan issuers, we expect the trailing-12-month Leveraged Loan Index default rate to more than double to 2.0% by June 2023 under our base case, still under the long-term historical average rate of 2.5%. Under our pessimistic case, we think defaults could increase to 4.25% over the same period. [1]

Given the typical 50% recovery rates, the estimated loss in the most pessimistic case would approximate 2.125% (i.e., half of the 4.25%), which is more than covered by the yield. Hence, returns appear attractive.

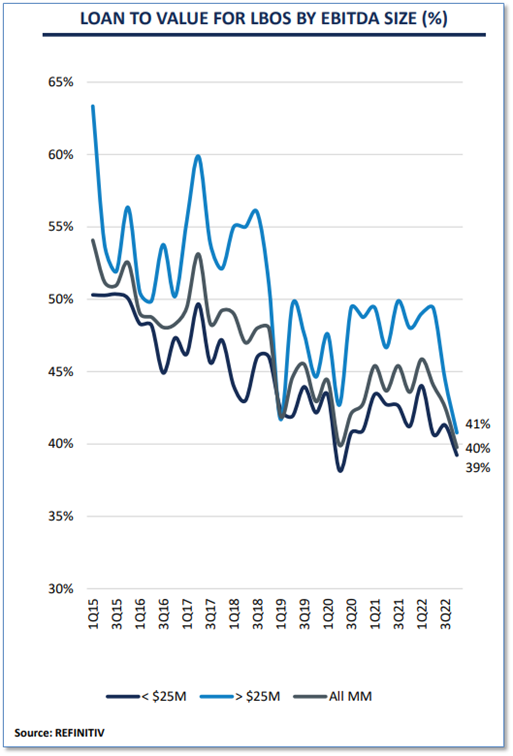

Before accepting the situation at face value, it is worthwhile to review credit quality. The below chart suggests that the loan to value for LBOs has declined over the past couple of years.

Figure II: LTV for LBOS By EBITDA Size (%)

Why do current conditions exist? Our view is that loan performance, FED funds rate hikes, and investor caution have led investors to reduce allocations thereby create a mismatch.

The Inflation Witch

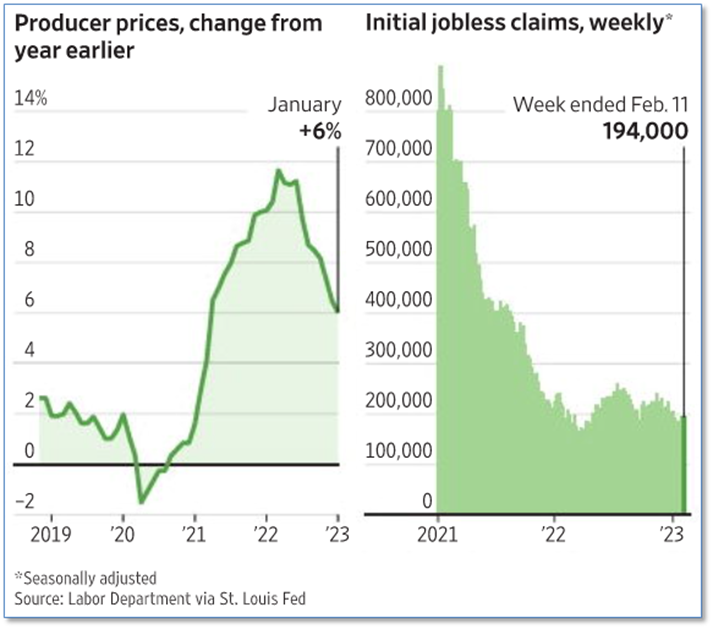

We have faced high inflation before, and markets have thrived. The rapid rise in rates and inflation persistence have spooked investors. Professor Steven Hanke of Johns Hopkins University has been fairly accurate in his inflation estimates. Per a recent WSJ editorial High Inflation Will End Soon:

“We are lowering our forecast for the year-over-year inflation rate from 5% to between 2% and 5% at the end of 2023” [2]

As can be seen below, M2 has declined recently. Time will tell whether the “Inflation Witch” is dead.

Figure III: Real M2 Money Stock (Billions of 1982-84 Dollars)

Figure IV: Prices Change & Jobless Claims

Ukraine Update

We cover Ukraine because of its massive impact on the global economy. The material and human costs of the war appear to be increasing. Putin’s gains are elusive as are those for the West. As usual, the winners are the defense-related firms and eventually, those involved in the reconstruction efforts. The European Union escaped the brunt of restricted natural gas supplies courtesy of a warmer than expected winter and a scramble for alternative sources. If Western support wanes, Ukraine will have difficulty offsetting Russia’s massive personnel advantage. However, to date, Ukraine has held its own. A game-changer would be Ukraine’s retaking Crimea, which might prompt armistice discussions.

Commodity Super Cycle

Commodity Super Cycles are caused by a dramatic rise in demand or cut in supplies. The last major one from our perspective was a cutting of petroleum supplies via the oil embargo prompting a significant rise in gasoline prices. While there is much talk of a shift to wind and solar power, the reality remains that much of the world remains dependent on fossil fuels. Furthermore, the push for electric vehicles has created demand for a variety of minerals. The problem is that for many institutional investors including banks, mining does not meet ESG standers resulting in restricted capital investment. Coal and petroleum production need to be watched.

__________________________________

[1] https://www.spglobal.com/_assets/documents/ratings/research/101567579.pdf

[2] Feb. 15, 2023, WSJ

How we can help

Egan-Jones Ratings Company started providing ratings in 1995 for the purpose of issuing timely, accurate ratings. EJR is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider. EJR is certified by the European Securities and Markets Authority (ESMA) and recognized as market leader in Private Placement ratings. EJR also provides independent credit rating research, Climate Change / ESG scores, and Proxy research and recommendations.

Prospective clients have often asked how we can help them and what areas we consider are particularly

strong. In response, below are the areas worth reviewing:

Private Placement Ratings – assisting investors access private markets via ratings on private placements.

Subscription Ratings – we have had a strong track record in providing early, accurate independent credit rating research.

Climate Change / ESG Scores – an assessment of entities’ current and prospective scores.

Independent Proxy Research and Recommendation/Voting – assisting fiduciaries in fulfilling their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.