Managing Manic Market Conditions; Most Likely Outcomes; Likely FED Funds Pivot; Japan Watch (Apr 2023)

Risk Commentary

Managing Manic Market Conditions; Most Likely Outcomes; Likely FED Funds Pivot; Japan Watch (Apr 2023)

Announcement: 2022 was a record year for Egan-Jones Ratings. The firm continued to cement its position as the leader in private debt ratings by issuing approximately 2,700 ratings - more than in any prior year. Our performance statistics continue to demonstrate our favorable default experience in 2022. Only one of our rated transactions in 2022 defaulted. It was previously rated CCC+. This was similar to prior years' default experience.

The markets have been dealing with the fallout of the failure of several US banks. With US federal support, the markets have stabilized. The failures were caused by several factors:

1. Losses on hold-to-maturity assets due to interest rate hikes

2. Concentration of deposits in a small number of depositors (who withdrew deposits quickly)

3. Unusual funding of longer-term assets with short-term securities

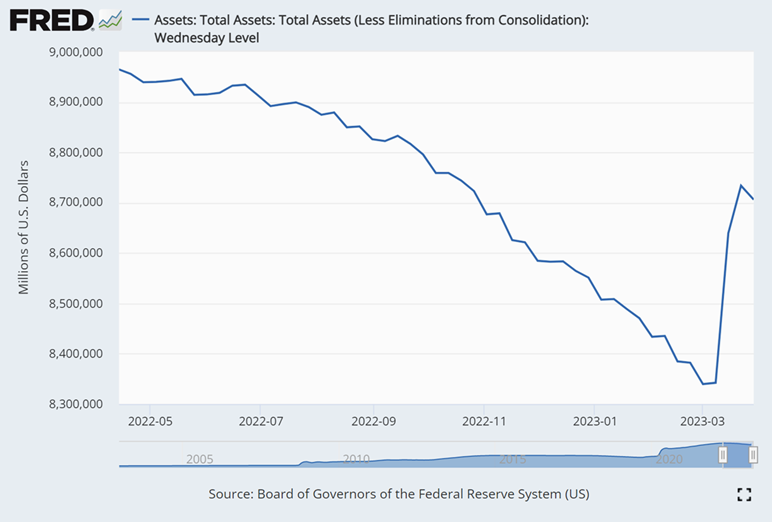

In response, the Fed, Treasury, FDIC, and others rapidly cobbled together a plan to provide support to the market. The Fed created the Bank Term Funding Program, which provided 100% advance rates to banks on eligible asset (US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets)[1] . Use of this program appears to be significant as shown by the below chart.

Figure I: Fed Total Assets ($m)

In normal circumstances a private institution could support the failing banks. The US federal government’s actions mirror those of the Bank of England which reversed Quantitative Tightening when UK pensions had difficulty meeting margin requirements. Interest rates hikes precipitated that event too. While central banks were responsible for raising rates, fund managers still need to properly manage risk, including duration and liquidity risk.

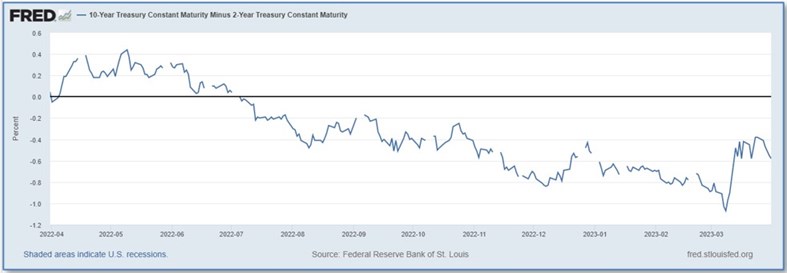

Many claim recession is near. Evidence for an upcoming recession is high nominal yields (i.e., above 15%) of broadly syndicated loans and the inverted yield curve, though it is inverted to a lesser degree than previously.

However, inflation appears to be abating as shown by the personal consumption expenditures (PCE) index. It rose just 0.3% month-over-month in February, which was slightly below the median estimate. Our view is that government support has reduced immediate downside risk and some long-term growth potential.

Figure II: 10-Year Treasury Yield Minus 2-Year Treasury Yield (%)

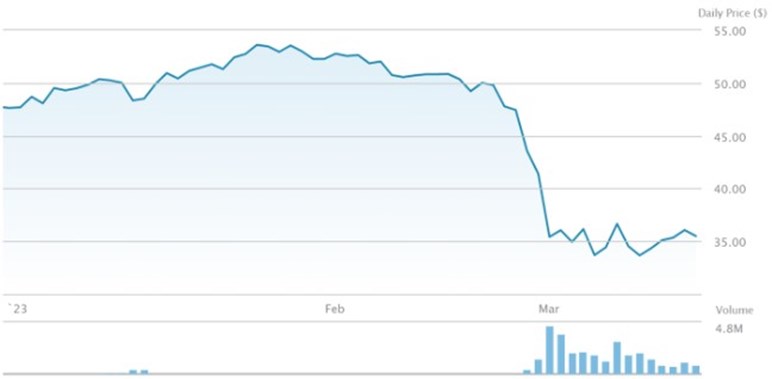

While regional bank stocks are down from 6 weeks ago, over the past 3 weeks, they have been flat. Note, banks with significant unrealized losses relative to shareholders’ equity might still face pressure.

Figure III: iShares U.S. Regional Banks ETF, IAT ($)

Likely FED Funds Pivot

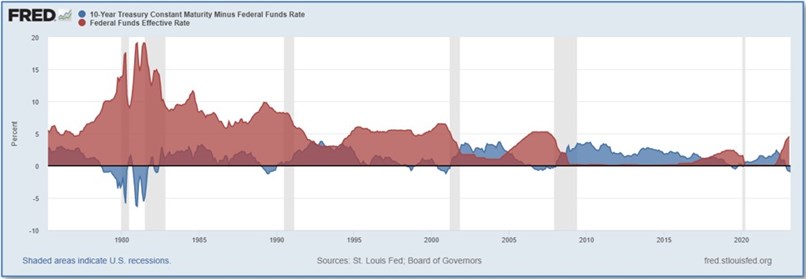

Many banks are likely to continue losing deposits as the returns available in money markets and T-Bills materially outweigh those available in bank deposits. An easy way to fix the problem is to cut Fed Funds rates, particularly given the upcoming US presidential election. Inflation decreases also offer cover for the Fed.

The below chart shows the 10-year less the Fed Funds Rate. When this is less than 0 (i.e., the blue area is below 0), the Fed Funds Rate (the red area) was cut shortly thereafter. However, the shaded vertical lines indicate recessions and therefore the condition might be more coincidental than causal. Nonetheless, empirically the linkage is strong.

Figure IV: 10-Year Treasury Yield Minus Fed Funds Rate & Fed Funds Rate (%)

Japan Watch

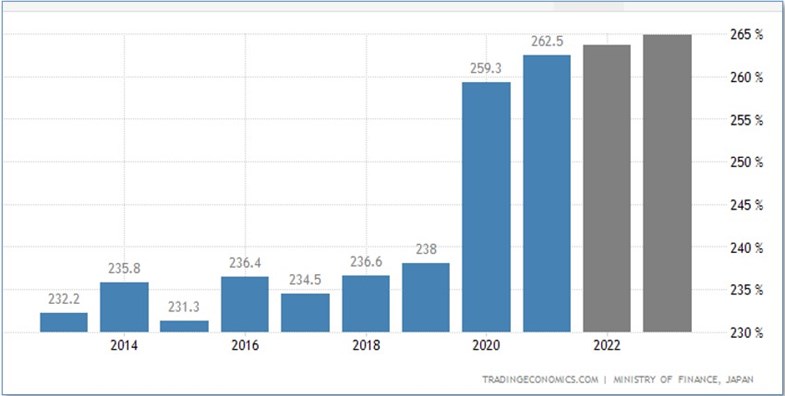

Japan has engaged in massive quantitative easing resulting in minimal interest rates on its government bonds. Additionally, Japan’s debt to GDP is near developing country highs at 262%.

Figure V: Japan Debt to GDP (%)

A major issue facing Japan’s new central bank governor, Ueda Kazuo, is the recent rise in inflation:

“In January, nationwide core consumer prices hit a 14-year high, rising by 4.2% from a year earlier, while wholesale prices jumped by 9.5%.” [2]

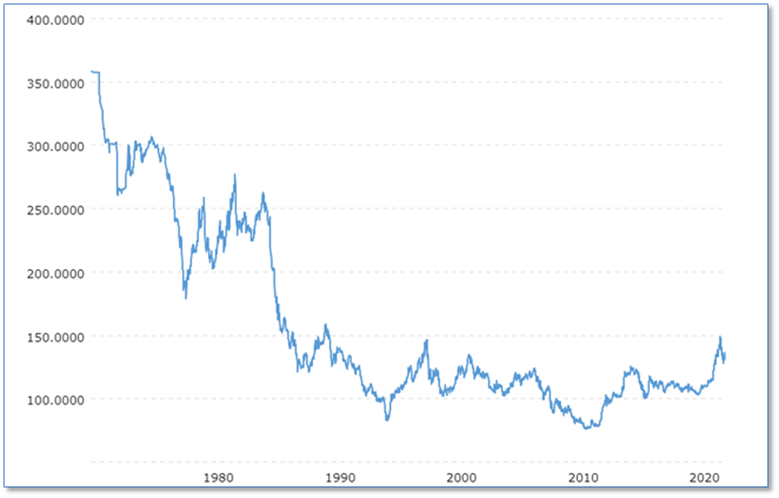

A rise in interest rates exacerbates the sovereign deficit while the collapse in the Yen may improve it. The stage is set for a possible policy reversal under Kazuo Ueda; Japanese investors are the biggest foreign holders of Treasuries.

Figure VI: Dollar-Yen Exchange Rate (Yen/Dollar)

____________________________________________

[1]https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312b.htm

[2}https://thediplomat.com/2023/03/japans-difficult-exit-from-easy-money/

How we can help

Founded in 1995, Egan-Jones is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the NAIC and is certified by ESMA. We can help in the following areas:

Requested Ratings – we assist investors access private and public markets via ratings.

Subscription Ratings – we provide early, accurate, and independent credit rating research.

Independent Proxy Research and Recommendation/Voting – we assist fiduciaries fulfill their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.