Predicting 12 of the last 2 recessions (Jan 2023)

Risk Commentary

Predicting 12 of the last 2 recessions (Jan 2023)

Announcement: 2022 was a record year for Egan-Jones Ratings. The firm continued to cement its position as the leader in private debt ratings by issuing approximately 2,700 ratings - more than in any prior year. Our performance statistics continue to demonstrate our favorable default experience in 2022. Only one of our rated transactions in 2022 defaulted. It was previously rated CCC+. This was similar to prior years' default experience.

Financial writers and economists are under constant pressure for attention. The more attention, the greater the demand for their views and in turn, greater compensation. Hence the adage:

“The typical economist has predicted twelve of the last two recessions”

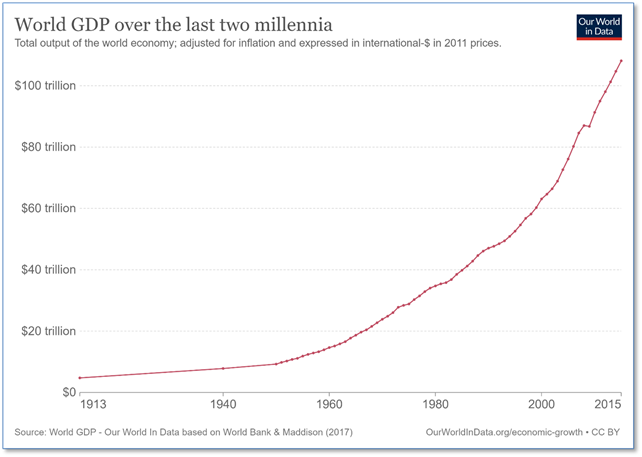

We try to take a different approach of being accurate and thereby provide the best information for clients. The item which is typically missed is the incredible growth bias of the U.S. and global economies. The below chart indicates that in real terms, the global GDP has grown massively since 1913.

Figure I: World GDP ($/year)

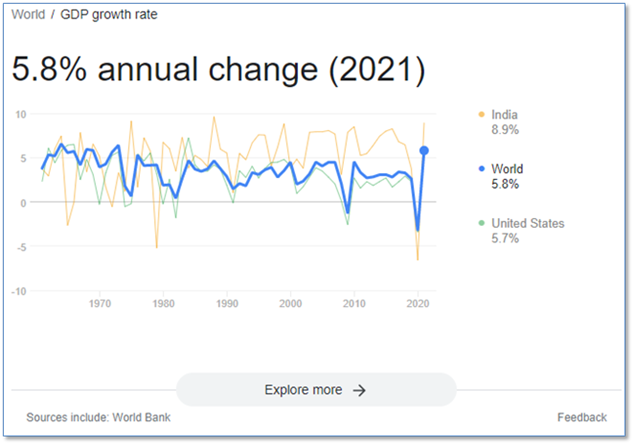

Taking another cut, the global economy appears to have grown at an average rate of slightly more than 5.0% per annum with the U.S. economy at approximately 5.0% per annum.

Figure II: GDP Growth Rate (% per year)

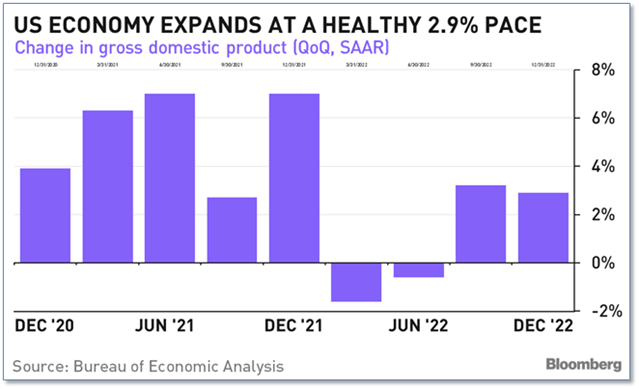

Figure III: Change in Gross Domestic Product

There are probably a multiplicity of reasons for this growth, but one might be that most countries tend over time, tend to organize themselves in a manner which provides the greatest benefit for their citizens. As of three hundred years ago, most countries were ruled by monarchies, with the standard approach being the assumption that royalty generally married royalty. The underlying assumption was that the ruling class was special and that it was unwise to question their legitimacy. Most countries either abandoned the monarchies or relegated royalty to primarily a public relations role with real involvement in government minimal. Ironically, some of the communist states appear to be adopting the approach of the monarchies with North Korea and China at the forefront. However, they are the exception. Even the Soviet Union jettisoned its form of government when it collapsed because of the poor allocation of resources. The successive Russian system adopted some Western governmental features, although one could easily argue that they are a sham under the Putin regime.

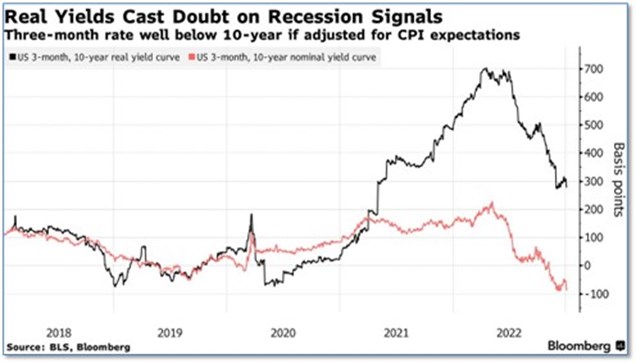

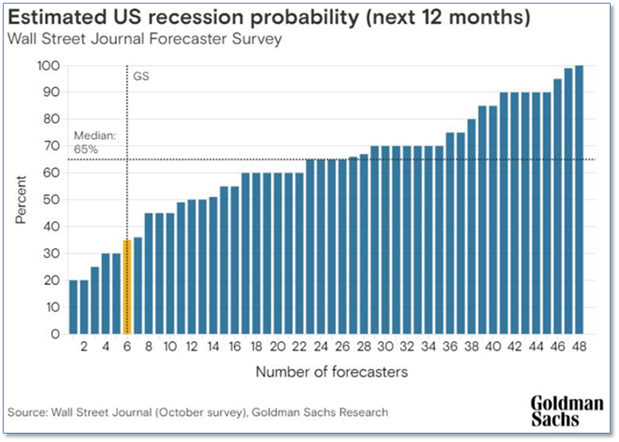

Our view is that the growth will continue and that the chances of a material recession have diminished. The below graphs support the notion of a diminished probability of recession, but perhaps the best way of expressing it is that if there is a recession, it will be relatively short and shallow.

Figure IV: 10-year vs 3-year yield (basis points of yield)

Figure V: US Recession Estimates (% of probability)

Major Risks

Therefore, we are moving on to addressing the major risks to the economy:

Ukraine War- while there is little doubt that the war has resulted in significant costs in terms of lives and resources, from a global perspective, it is likely to have little impact. Apparently, the nuclear option is off the table and therefore most likely outcomes appear manageable. We would not be surprised by Ukraine’s “thunder run” (i.e., a rapid run behind enemy lines akin to Rommel’s run through Western Europe) in Crimea, thereby encouraging Russia to the bargaining table with a major item being access to the strategic port of Sevastopol. A continuation of the war is a bonanza for the defense industry but offers little benefit to everyone else.

Debt Ceiling - McCarthy needed 15 votes to become House leader, thus providing negotiating leverage to the House Freedom Caucus. However, if McCarthy has trouble maintaining support from his own party, we expect Democrats will support a more liberal package.

Supply Line Repatriation - the Biden administration has made it a priority to reduce dependency on China for critical components and restrict the supply of high-tech items such as computer chips to China. This area has the potential for spiraling out of control if not handled properly.

Taiwan - perhaps the major benefit from the Ukraine conflict is the underscoring of the difficulty associated with land grabs. Russia had the benefit of multiple land routes into Ukraine and is still struggling whereas amphibious assaults are problematical under the best circumstances. The Strait of Taiwan is 110 miles compared to the English Chanel’s 21 miles, making invasion much more difficult.

Document Scandal - the discovery of top-secret documents in multiple locations has dominated the news cycle over the past couple of weeks raising the question of whether it will hobble the current administration or derail reelection efforts. Our view is no to the former question and on the later question, elections are a long way off.

Japan’s Recent Monetary Action - the increase in the trading band of the 10-year government bonds roiled the markets but we expect Japan will muddle through with the aid of its highly supportive business community.

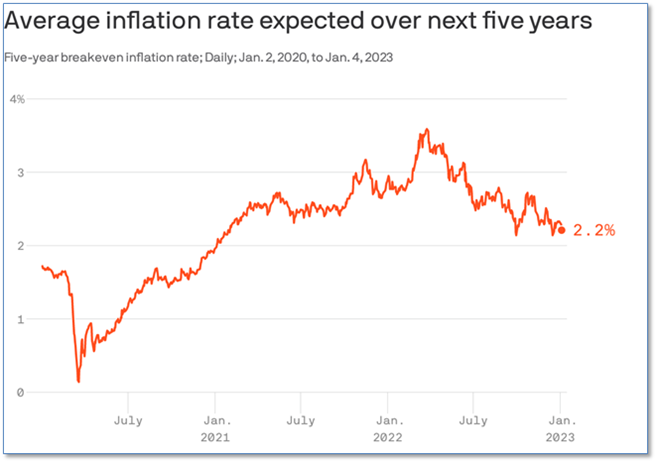

Inflation and FED rates - we place this item last as we believe it has already been addressed and that if there are additional rate increases from the FED, they will be minimal. The below chart provides comfort.

Figure VI: Average Expected Inflation Rate (five-year breakeven rate) [1]

__________________________________

[1] https://fred.stlouisfed.org/series/T5YIE

How we can help

Egan-Jones Ratings Company started providing ratings in 1995 for the purpose of issuing timely, accurate ratings. EJR is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider. EJR is certified by the European Securities and Markets Authority (ESMA) and recognized as market leader in Private Placement ratings. EJR also provides independent credit rating research, Climate Change / ESG scores, and Proxy research and recommendations.

Prospective clients have often asked how we can help them and what areas we consider are particularly

strong. In response, below are the areas worth reviewing:

Private Placement Ratings – assisting investors access private markets via ratings on private placements.

Subscription Ratings – we have had a strong track record in providing early, accurate independent credit rating research.

Climate Change / ESG Scores – an assessment of entities’ current and prospective scores.

Independent Proxy Research and Recommendation/Voting – assisting fiduciaries in fulfilling their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.