2022 Progress, 2023 Risks, 2023 Possible Surprises (Jan 2023)

Risk Commentary

2022 Progress, 2023 Risks, 2023 Possible Surprises (Jan 2023)

In this commentary, we review 2022 progress, major risks for 2023 and possible surprises.

I. 2022 Progress

Moderating Petroleum Prices

As of the start of 2022, petroleum prices were rapidly rising, with the result that gasoline prices reaching all-time highs. As can be seen below, prices have moderated .

Figure I: Crude Oil WTI(USD/Bbl) [1]

EU Natural Gas Availability

With cuts in Russian energy, natural gas prices elevated, and there was a possibility that the EU would be left in the cold. As can be seen below, prices have moderated .

Figure II: Natural Gas EU Dutch TTF (EUR/MWh)[2]

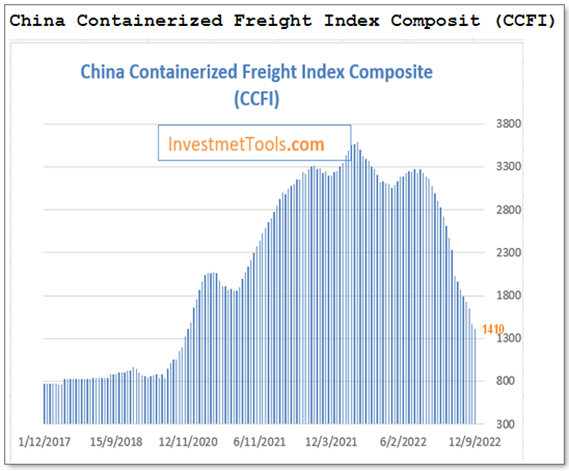

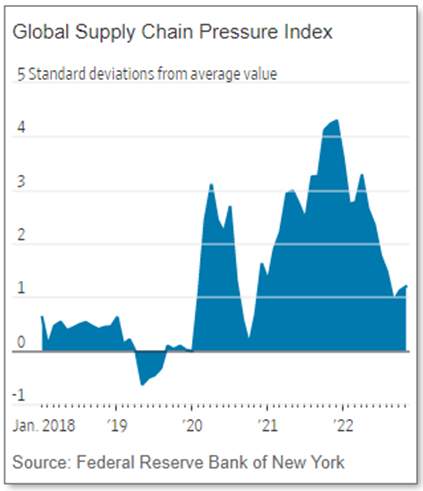

Supply Chain Unclogged

In early 2002 supply chains faced major clogs with ships waiting days before gaining port access. Per a recent WSJ article (“Supply Chains Upended by Covid Are Back to Normal” ) and the graphs below , the constipation has eased.

Figure III: China Containerized Freight Index Composite (CCFI)[3]

Figure IV: Global Supply Chain Pressure Index [4]

COVID Abatement

The disease was a modern-day Spanish Flu causing massive disruption to all parts of the economy. While China is experiencing heightened cases, most of the rest of the world has recovered and looks upon new infections as merely a nuisance.

Russian Miscalculation

Sensing an opportunity, Russia invaded Ukraine in the hope of re-establishing USSR-era borders and plugging access points to the Russian heartland. The adventure has been a disaster with the strong possibility that Russia will lose Crimea and will take years to rebuild its military. Even if Putin steps down, sanctions are likely to remains for years, NATO has been expanded and is more united than in any recent times.

China Taiwan Aggression Tempered

Russia’s experience in Ukraine is likely to temper China’s near-term aggressiveness towards Taiwan; assaults over land are difficult, and amphibious assaults over 100 miles of water are significantly more problematical. With Japan’s and Australia’s rearmament efforts, the Allies progress in Ukraine, and the tension between India and China, the probability of a vigorous response to any aggression increases.

Inflation Taming

The casus belli for the unprecedented rapid rise in interest rates has been inflation, but it appears that petroleum and housing prices have moderated. While few mention it, there is currently a contradiction in the federal government’s fiscal policy (i.e., expansionary courtesy of the $2.0T COVID-19 CARES Act, $500B Inflation Reduction Act and the recently-passed $1.65T Omnibus Spending Act) and its monetary policy (quantitative tightening and interest rate increases). Given the fact that the additional interest expense stemming from the rate rises and the resulting deficits and the moderation of inflation, increases in FED rates are likely to temper.

II. Risks (Short to Medium Term)

Inflation

At its heart, inflation in goods and services is caused by demand exceeding supply. We expect the shift of control in the House is likely to temper some of the fiscal spending.

Interest Rates

Some suggest the FED will continue to increase rates until “they break something”, that is cause a recession. Our view is that the increases have already caused major disruption but that it will take time to be manifested.

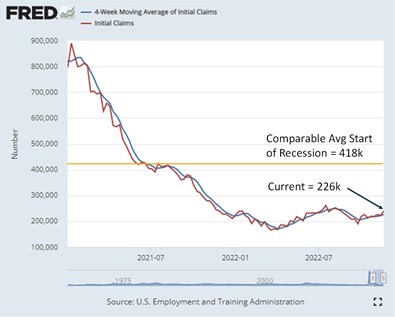

Low Unemployment

Normally low unemployment is a positive in the sense that it indicates that the economy is serving the population well by providing job opportunities to those seeking work. However, in the current context, low unemployment stokes inflationary pressures via increased labor costs. While technology will help (i.e., factory automation tools and eventually self-driving automobiles and trucks), the retirement of the Baby Boomers is likely to depress unemployment levels.

Recession

We did not place this item at the top of the list because to date, domestically, the economy appears to be in decent shape with “inflation-adjusted gross domestic product, or the total value of all goods and services produced in the economy, increased at a 3.2% annualized rate during the period, Commerce Department data showed Thursday. That compares with a previously reported 2.9% advance.” [5] As indicated in the chart below, the probability of recession is low when unemployment is low.

Figure V: US Jobless Claims [6]

There are numerous longer-term risks, but we will address them in subsequent installments. (On the sovereign front, among the larger economies, China, Japan and the UK warrant attention.)

III. Potential Positive Surprises

Ukraine War Ending

The war is nearly one year old and has caused massive global disruptions to energy, food, fertilizers, etc. and has been incredibly expensive. If Ukraine is able to cut supply lines to Crimea (which appears to be possible and perhaps likely), the tenor of the conflict is likely to change with the likely result being some sort of armistice.

Fusion Energy

The recent breakthrough whereby more energy was created than expended provides massive hope for the generation of clean energy.

Lame Duck Congress

With Republicans taking control of the House, little is likely to be accomplished.

________________________________

[1] https://tradingeconomics.com/commodity/crude-oil

[2] https://tradingeconomics.com/commodity/eu-natural-gas

[3] https://investmenttools.com/futures/bdi_baltic_dry_index.htm

[4] https://www.wsj.com/articles/supply-chains-upended-by-covid-are-back-to-normal-11671746729?mod=djemalertNEWS

[5] https://www.bloomberg.com/news/articles/2022-12-22/us-third-quarter-gdp-revised-higher-to-3-2-on-firmer-spending?cmpid=BBD122222_CUS&utm_medium=email&utm_source=newsletter&utm_term=221222&utm_campaign=closeamericas

[6] https://fred.stlouisfed.org/series/ICSA

How we can help

Egan-Jones Ratings Company started providing ratings in 1995 for the purpose of issuing timely, accurate ratings. EJR is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the National Association of Insurance Commissioners (NAIC) as a Credit Rating Provider. EJR is certified by the European Securities and Markets Authority (ESMA) and recognized as market leader in Private Placement ratings. EJR also provides independent credit rating research, Climate Change / ESG scores, and Proxy research and recommendations.

Prospective clients have often asked how we can help them and what areas we consider are particularly

strong. In response, below are the areas worth reviewing:

Private Placement Ratings – assisting investors access private markets via ratings on private placements.

Subscription Ratings – we have had a strong track record in providing early, accurate independent credit rating research.

Climate Change / ESG Scores – an assessment of entities’ current and prospective scores.

Independent Proxy Research and Recommendation/Voting – assisting fiduciaries in fulfilling their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.