Waiting for Godot (July 2023)

Risk Commentary

Waiting for Godot (July 2023)

Samuel Beckett’s masterpiece was voted the "most significant English-language play of the 20th century” in a poll conducted by the British Royal National Theatre in 1998/99.[1] In the play, Vladimir and Estragon are waiting for Godot, and continue to do so for the balance of the play. In the end, Godot never appears, and the audience is left bewildered. Perhaps there is a parallel with the current economic conditions whereby for the past several years, many have been waiting for the recession (and for the more pessimistic, another depression), but to date none has arrived and perhaps might still be relegated to sometime in the future.

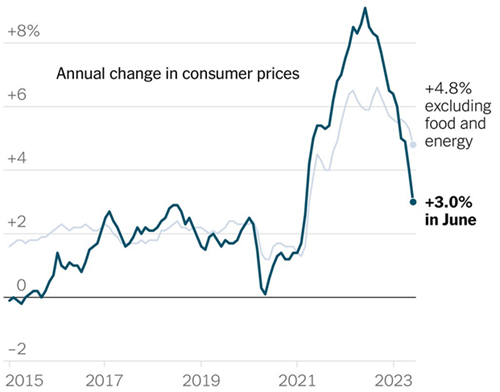

The latest inflation data provides solace to those hoping for a reprieve from the relentlessly increasing Fed Funds rates.

Figure I: Annual change in consumer prices

Adding solace are comments from Lloyd Blankfein who is suggesting (along with others) that a “soft landing” is becoming increasingly likely: Blankfein Says US Economic Data Show Path to Avoiding Recession, Bloomberg [2]

If the inflation indicator is accurate, and assuming 10-year Treasuries should trade at a level comparable to inflation, then we are looking at an ideal environment for fixed income corporate investors: attractive yields which are manageable for most borrowers and yet minimal defaults.

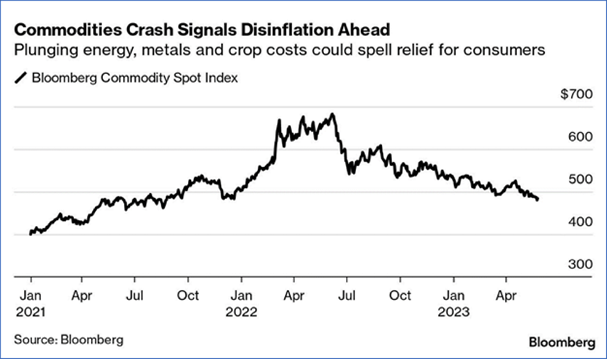

For the sceptics (i.e., in this case, those who question the government’s statistics), perhaps the commodity and export/ import prices provide some comfort. As can be seen below, since last June, the index has declined from nearly $700 to less than $500.

Figure II: Bloomberg commodity spot index ($)

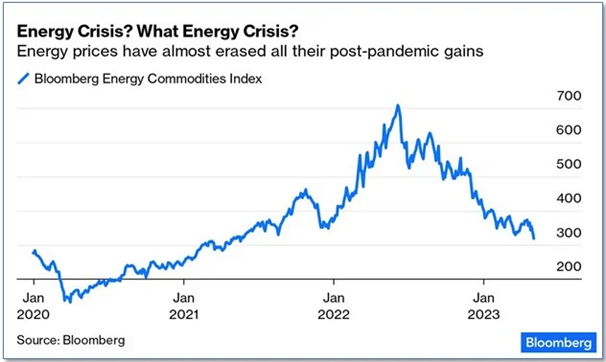

The case is even more dramatic for energy, which as can be seen below, is down from $700 a year ago to approximately $300 currently.

Figure III: Bloomberg energy commodities index

For those seeking additional conformation, we suggest St. Louis Fed’s FRED and its Export/ import prices information[3][4].

Takeaway

Inflation and overall interest rates are key considerations for most sophisticated risk managers and both items appear to be moderating, leaving the path clear for producing what in retrospect might be one of the better risk-adjusted vintages for fixed income investing.

Sources

[1] "Waiting for Godot voted best modern play in English" by David Lister, The Independent, 18 October 1998

[2] https://www.bloomberg.com/news/articles/2023-06-30/blankfein...

[3] https://fred.stlouisfed.org/series/IR

[4] https://fred.stlouisfed.org/series/IQ

How we can help

Founded in 1995, Egan-Jones is a Nationally Recognized Statistical Rating Organization (NRSRO) and is recognized by the NAIC and is certified by ESMA. We can help in the following areas:

Requested Ratings– we assist investors access private and public markets via ratings.

Subscription Ratings – we provide early, accurate, and independent credit rating research.

Independent Proxy Research and Recommendation/Voting – we assist fiduciaries fulfill their voting and record-keeping obligations.

Egan-Jones rates a wide variety of private placements:

Aircraft Lease and Loans

Airline Lease Back

Asset-backed loans

Bank, BDCs

Credit Facility/ Warehouses

Corporates

Credit-Tenant Loans (CTLs)

Equipment Leases

Financial Institutions

Ground Leases

Insurance

Middle Market Lending

Project Finance

Real Estate, REITs

Specialty Finance

CRE Loans, Other

Funds:

Closed-end Funds

Credit Funds

CRE Funds

Direct Lending Funds

Feeder Funds

Infrastructure Funds

Liquidity Funds

Mezzanine Funds

Mixed Strategy Funds

Opportunistic Funds

Real Estate Funds

Structured Debt Funds

Click here to view sample Private Placement transactions.